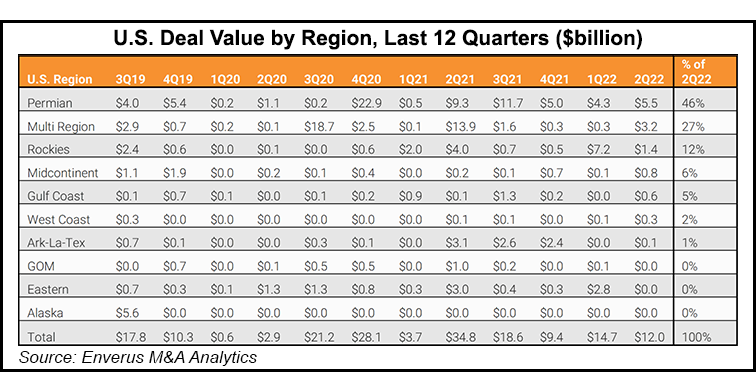

Mergers and acquisitions (M&A) in the U.S. upstream oil and gas segment dipped sharply in the second quarter to $12 billion in transactions, almost two-thirds below the $34.8 billion in the year-ago period, according to the latest tally by Enverus.

Private equity (PE) firms accounted for about 80% of the latest quarter’s deal value, with nearly half the total concentrated in the Permian Basin, researchers found.

“As anticipated, the spike in commodity prices that followed Russia’s invasion of Ukraine temporarily stalled M&A as buyers and sellers disagreed on the value of assets,” said Enverus director Andrew Dittmar.

[Now Available: No-Code NGI Data Sync to Your Excel Spreadsheet – Get NGI’s New Excel Add-in. ]

“High prices, though, also encouraged a rush by PE...