North American E&P Credit Quality Improving, Still Lagging Boom Years

Fundamentals are more robust today, but most North American exploration and production (E&P) companies’ credit metrics are still much weaker than the boom years of 2013-2014, Moody’s Investors Service said Monday.

Through 2019, E&P credit quality should strengthen steadily, particularly for operators with disciplined spending and sustainable free cash flow (FCF), even while improving more quickly for those that substantially bring down their debt.

Moody’s report compares the financial performance of the 35 largest rated North American E&P companies, and compares how their 2017 credit metrics stack up against those of 2013-2014, before oil prices collapsed.

“Higher oil prices and very low production and development costs helped North American E&P companies substantially improve their operating and financial performance in 2017,” said Vice President Sajjad Alam. “Nevertheless, most companies still have significantly higher leverage, lower cash margins and weaker capital productivity metrics — and thus higher credit risk — than they did before the downturn.”

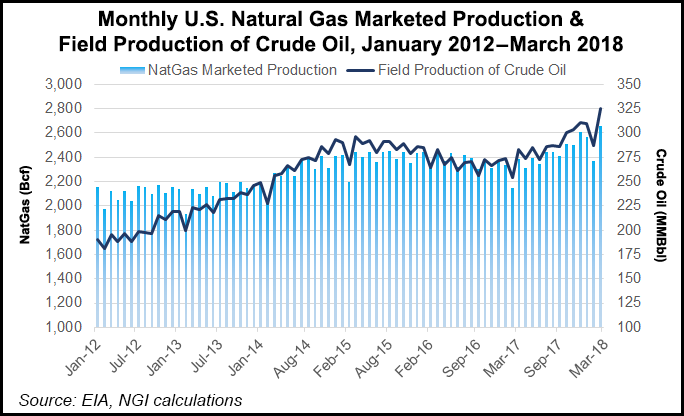

U.S. oil and gas production reached record levels in early 2018, and the Moody’s analysts expect robust volume growth “at least through 2019 as companies continue to take

advantage of their improved productivity, efficiency and low cost structures. Ongoing

focus on highest quality and shorter cycle assets will also help add meaningful reserves.”

There are “emerging logistical and labor problems in the top producing U.S. basins,” which could put a temporary lid on volume growth. A decision to move away from the self-imposed production restrictions — for now — by the Organization of the Petroleum Exporting Countries, i.e. OPEC, and Russia “could also weigh on oil prices, thus discouraging incremental E&P investments.”

For the E&Ps reviewed, aggregate debt has remained unchanged since 2014, and most operators don’t have sufficient FCF to pay down debt this year. Leverage is more likely to improve through earnings growth, Alam said.

Revenue and margins also remain well below 2013-2014 levels, with median revenue/boe 39% lower and unleveraged cash margin/boe 47% lower in 2017.

“Even so, margins will continue to recover this year, though more slowly than they did last year, given rising production costs,” said researchers.

Meanwhile, the median leveraged full-cycle ratio (LFCR) last year likewise was 47% weaker than in 2013-2014. Improvement to LFCR is going to have to come mostly on higher commodity prices as oilfield service costs continue to rise.

“Despite many favorable developments in 2017-18, it will take more time for North American E&P companies to regain their pre-downturn financial strength,” Alam said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |