E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Bottlenecks, Shmottlenecks, Permian Activity and Investments Still Strong

The Permian Basin may be facing oil and natural gas pipeline bottlenecks, as well as a dearth of supplies and labor, but that has not stopped activity levels and investments from increasing, particularly by private operators.

The most active oil and gas basin in the United States has faced increasing logistics challenges following the sharp uptick in activity last year, with the biggest issues centering around insufficient pipeline takeaway capacity for oil and gas. However, the need for more infrastructure is far from the only concern, according to analysts.

Fracture sand supply delays along with a shortage of in-basin logistics, labor and pressure pumping supplies, “should not be underestimated,” Rystad Energy analysts said.

Each bottleneck “raises concerns about the potential of Permian oil production in the short- and medium-term, along with the severity of associated costs escalation. These challenges come on top of pressure from the investor community for organic growth.”

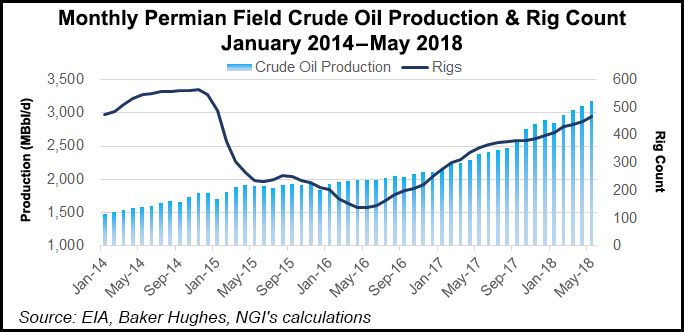

For the week ended June 1, Baker Hughes Inc. recorded 477 Permian rigs in action, down one from the week before but up from 364 one year ago.

The sharp growth in Permian activity also is showing up in other metrics. The Federal Reserve Bank of Dallas on Monday noted that Texas accounted for 1,980 of U.S. mining jobs added in March. April data showed a further increase of nearly 4,490 jobs in the state, including 230 in extraction and 4,260 in support activities.

According to the Texas Workforce Commission, the state added 3,400 upstream oil and gas jobs in April, making it the 17th consecutive month of upstream job growth. Texas has recovered 33% of jobs lost between the high point in employment in December 2014 and the low point in September 2016. During that time, employment in the Texas upstream sector has grown by 38,400 jobs.

“Record production in the Permian Basin is driving sustained job growth in Texas,” said Texas Oil & Gas Association President Todd Staples. “Investment and innovation in the oil and natural gas industry are not only creating good jobs for Texans but also securing our economy, our environment and our future.”

Meanwhile, the horizontal rig count in the Permian has been growing gradually since the start of this year, rapidly outdistancing what had been de rigueur for decades in the Permian, vertical drilling.

“In fact, horizontal permitting activity, which is often viewed as a leading indicator of short-term activity, increased in an even more impressive way, renewing an all-time high level in 1Q2018,” Rystad’s team noted. “As many as 1,978 horizontal permits to drill were approved in the Permian Basin from January to March 2018, which corresponds to a 22% growth sequentially and a 37% growth on an annual basis.”

As of June 1, about 89% of the wells drilled in the Permian were horizontals, according to Energent Group. Of those, 81.4% were drilling for oil, the rest for natural gas. Most of the wells had laterals that were 10,000-15,000 feet long.

Many of the largest publicly traded exploration and production companies, including Big Oil operators, working the Permian have responded to investors’ calls to build organically and not overspend. Their contribution is showing up in total permitting activity, which for the large exploration and production (E&P) companies has declined in recent quarters.

However, permits requested by smaller public E&Ps, primarily the pure-plays, have not changed since 3Q2016, according to Rystad data.

“It is therefore mainly private operators that have been gaining this segment of the market share systematically since mid-2016,” the only group of E&Ps showing growth in the last four quarters.

Data also indicated that the privately held E&Ps reached an all-time high in 1Q2018 with 25% of the Permian permits approved, according to Rystad.

Another trend is a continuing gain by new entrants that are privately held and backed by private equity (PE) funds.

Between 2012 and 2014, 24-32 private E&Ps each year entered the Permian, Rystad said. As oil prices retreated, private capital dried up, falling to only 11 in 2015. Since costs have declined and oil prices have strengthened, the number of new private entrants recovered to 28-19 per year in 2016-2017.

In the first four months of this year, as many as nine privates receiving their first horizontal permit approval, Rystad noted. The interest has since continued by privately held E&Ps and midstream operators.

In April Ares Management LP and ARM Energy Holdings LLC formed Salt Creek Midstream LLC to develop multiple cryogenic processing facilities, natural gas and crude gathering lines and compression/treating facilities in the Delaware sub-basin.

On Tuesday, PE-backed DoublePoint Energy LLC, formed by Double Eagle Energy Holdings III LLC and FourPoint Energy said it would use its combined 70,000-plus acres in West Texas to build a powerhouse E&P focused on the Midland formation.

Rystad analysts said “there are reasons to expect that the annualized estimate of 27 new private entrants in 2018 will end up on the conservative side. Yet, even this conservative estimate will bring the level of interest back to pre-downturn levels.”

Data indicate a “strong” expansion recently by private E&Ps in an area it terms the Midland North, which would be in West Texas, where activity has moved into the development phase.

“The current state of the Permian Basin, seen from our perspective, therefore calls for a further consolidation,” said Rystad analysts. They are “convinced” of more deals ahead that are similar to Concho Resources Inc.’s $9.5 billion takeover in March of RSP Permian Inc., which created a Permian pure-play with close to 640,000 net acres.

The Concho deal is said to be the largest U.S. upstream merger since 2012 and the largest “purely Permian deal ever,” according to Wood Mackenzie.

More deals like Concho-RSP, said Rystad’s team, “are needed and are bound to happen in the future as operators start thinking about optimal long-term development and the competitiveness of the Permian Basin in the global context.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |