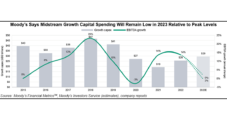

The global midstream energy industry is likely to expand only modestly through 2023 and next year, given slumping natural gas prices and stubbornly high inflation, according to Moody’s Investors Service. The rating agency’s research arm, in a new outlook, emphasized the modest growth would follow strong performances across 2022, a year in which energy demand…

Moody'S

Articles from Moody'S

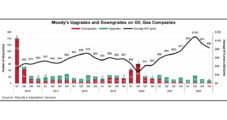

Natural Gas, Oil E&Ps Improve Credit Ratings Amid High Prices, Capital Discipline

Oil and gas companies had a record year in 2022 and continued to improve their positions in the eyes of investors. In a new report, credit ratings analysts at Moody’s Investors Services said upgrades in the oil and gas industry far outpaced downgrades in 2022, mainly because of considerable debt reduction policies at companies across…

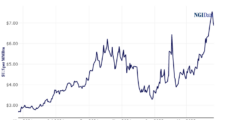

Do U.S. E&Ps Need Higher Natural Gas Prices to Offset Demand and Inflation? Yes, Says Moody’s

Natural gas development costs in the United States are rising, stung by rising consumption, inflation, supply chain issues and labor shortages, all of which are eating away at the margin, according to Moody’s Investors Service. The credit ratings agency recently hiked its medium-term Henry Hub natural gas price range by 50 cents to $2.50-$3.50/Mcf. The…

Higher Commodity Prices, Strengthening Economies Improve Outlook for Global Energy Demand, Moody’s Says

Moody’s Investors Service has upgraded its outlook for the global energy industry, citing a sustained increase in commodity prices and expectations for global economic growth to drive increased oil and gas demand over the next 12 to 18 months. The firm said it expects that, as vaccine programs become prevalent and the coronavirus outbreaks fade,…

California Utilities Said Facing Fewer Wildfire Financial Risks

While the physical risks of California wildfires are projected to increase, actions by courts, lawmakers and regulators over the past 12 months have lowered the state’s financial exposure, according to Moody’s Investors Service.

Moody’s Sees Public Power Utilities Staying Resilient Through Pandemic, Demand Impacts Varying Widely by State

Moody’s Investors Service said this week it is maintaining a stable outlook for the U.S. public power sector through the Covid-19pandemicand resulting economic downturn.

NGI The Weekly Gas Market Report

U.S. Natural Gas Price Forecasts Evolving as Coronavirus, Oil Price Slump Roil Markets

Natural gas prices are forecast to be pressured into 2021, with potential relief as associated output falls on reduced oil drilling and more coal-to-gas switching, according to analysts.

NGI The Weekly Gas Market Report

Natural Gas, Power Utilities Said Well-Positioned to Weather Coronavirus Impacts

Regulated natural gas and power utilities are relatively well positioned to weather the economic impacts of the Covid-19pandemic, according to a new report by Moody’s Investors Service.

NGI The Weekly Gas Market Report

U.S. E&Ps Facing ‘Extensive Credit Shock’ on Coronavirus, Low Oil Prices

As Lower 48 natural gas and oil producers signal cutbacks to spending and activity, the latest data on permitting indicates operators already are “clearly retreating” in the wake of a devastating decline in oil prices and the effects of the Covid-19 pandemic.

Lower 48 E&Ps Punch Back by Cutting Capex as Oil Prices Decimated

A slew of Lower 48 oil and natural gas producers reacted swiftly to the plummet in crude prices Monday by reducing planned spending and activity through the rest of the year.