E&P | Earnings | LNG | LNG Insight | NGI All News Access | Shale Daily

Noble Energy Brings Back Curtailed DJ, Permian Volumes

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2158-8023 |

Earnings

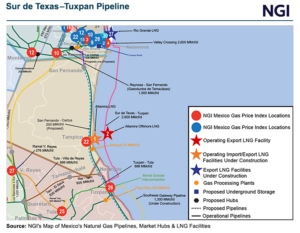

New Fortress Energy Inc. (NFE) expects its floating LNG (FLNG) platform offshore Altamira, Mexico to produce first volumes later this month after experiencing a mechanical issue in April. NFE management in the first quarter earnings report said that the first cargo could be loaded at the liquefied natural gas facility in June. The company previously…

May 8, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.