Chevron Corp. continues to see lower demand for oil and natural gas from Covid-19, but it is focusing on what it can control, CEO Michael Wirth said. The San Ramon, CA-based major issued its third quarter results Friday, highlighting the completion of its takeover of Noble Energy Inc. and the startup of some alternative energy…

Noble

Articles from Noble

Chevron Completes Noble Energy Acquisition

Chevron Corp. said Monday that it has completed its acquisition of Noble Energy Inc. after Noble’s shareholders approved the transaction last week. Chevron in July clinched a definitive agreement in an all-stock transaction worth $5 billion that carried a total enterprise value, including debt, of $13 billion. The transaction, which at the time valued Noble…

Noble Energy Brings Back Curtailed DJ, Permian Volumes

Most of Noble Energy Inc.’s Lower 48 oil and gas volumes that were curtailed as the coronavirus sapped demand are back online as operating costs and netback pricing have improved. The Houston-based super independent, which issued its results Monday, curtailed 30,000 boe/d net during 2Q2020. Most of the reduced volumes, estimated at 80%, were curtailed…

NGI The Weekly Gas Market Report

Noble Energy Expects Rising Summer Natural Gas Demand in Eastern Med, but Shut-ins, DUCs in Lower 48

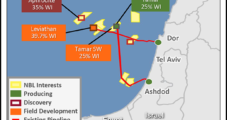

Super independent Noble Energy Inc., whose vast U.S. portfolio extends across Texas and Colorado, plans to move cautiously through the year in the Lower 48 by shutting in wells and clawing back activity, while it works to build natural gas infrastructure overseas.

NGI The Weekly Gas Market Report

4Q2019 Earnings: Noble Ties Natural Gas Growth to Leviathan, with Lower 48 Liquids Driven by DJ, Permian

Houston-based Noble Energy Inc. spent less and produced more in 2019, boosted by the ramp of the Leviathan natural gas field offshore Israel and better performance from Lower 48 properties in Colorado and Texas.

Leviathan Natural Gas Field Offshore Israel Ramps Up on New Year’s Eve

Houston-based Noble Energy Inc. hit its target to start up natural gas production from its massive Leviathan project offshore Israel with output starting on the final day of 2019.

Natural Gas Volume Commitments Doubled from Leviathan, Tamar Fields Offshore Israel

Houston super independent Noble Energy Inc., which is leading the development of two Eastern Mediterranean natural gas fields offshore Israel, plans to double firm volume commitments to Egypt’s Dolphinus Holdings Ltd. and extend the sales terms.

Black Diamond Crude Line Doubles DJ Basin Acreage, Mulls Stake in Saddlehorn

Black Diamond Gathering LLC, a joint venture (JV) of Noble Midstream Partners LP and Greenfield Midstream LLC, has doubled its crude gathering volumes in the Denver Julesburg (DJ) Basin with a new deal, and is considering a stake in another oil pipeline that moves volumes from the Rockies to storage in Cushing, OK.

Noble Energy Sees ‘Inflection Point’ in U.S. Onshore as Efficiencies Exceeding Guidance

Houston super independent Noble Energy Inc. is bringing costs down and production up in the Lower 48, with output from its main basins, the Permian Delaware and Denver-Julesburg (DJ), each hitting record output during the second quarter.

NGI The Weekly Gas Market Report

Noble Holds Capex Steady as Leviathan Nears Completion, U.S. Onshore Plays Expand

Higher commodity prices will not dissuade Noble Energy Inc. from its pledge to hold capital spending down this year, even as it prepares for starting up the massive natural gas project offshore Israel and for more U.S. onshore opportunities.