Markets | LNG | Natural Gas Prices | NGI All News Access

Natural Gas Futures Tumble Below Key $6.50 Threshold on Improving Winter Supply Outlook

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

Regulatory

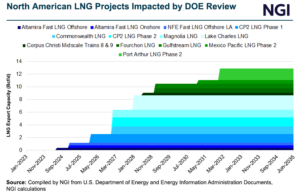

While regulatory uncertainty from the Department of Energy (DOE) hangs over U.S. LNG development, former FERC Chairman Neil Chatterjee sees the pathway for permitting at the Commission improving. The liquefied natural gas industry’s focus has largely been pulled to the DOE since January, when the Biden administration ordered the agency to study the impact of…

May 8, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.