Against a backdrop of persistently wild swings, natural gas forward prices came tumbling down during the trading period from May 5-11, according to NGI’s Forward Look.

June fixed natural gas prices averaged $1.130 lower on the week, with both the balance of summer (June-October) and the upcoming winter (November-March) also dropping more than $1.00, Forward Look data showed.

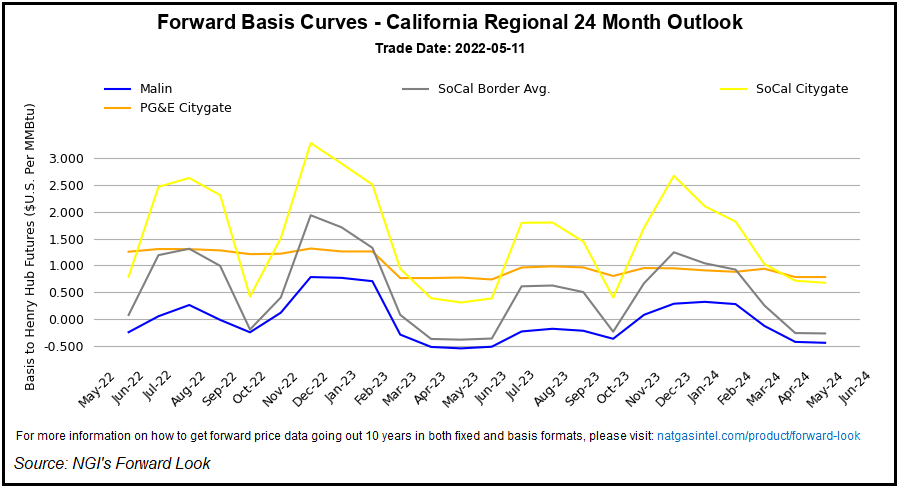

There was little deviation among U.S. pricing locations, with natural gas basis prices less than a dime changed on the week.

Trouble Out West

One major exception was PG&E Citygate, where June basis jumped 19.0 cents during the period to plus $1.256, according to Forward Look. July basis climbed 13.0 cents to plus $1.306, while the balance of summer edged up to plus $1.270.

Ongoing maintenance...