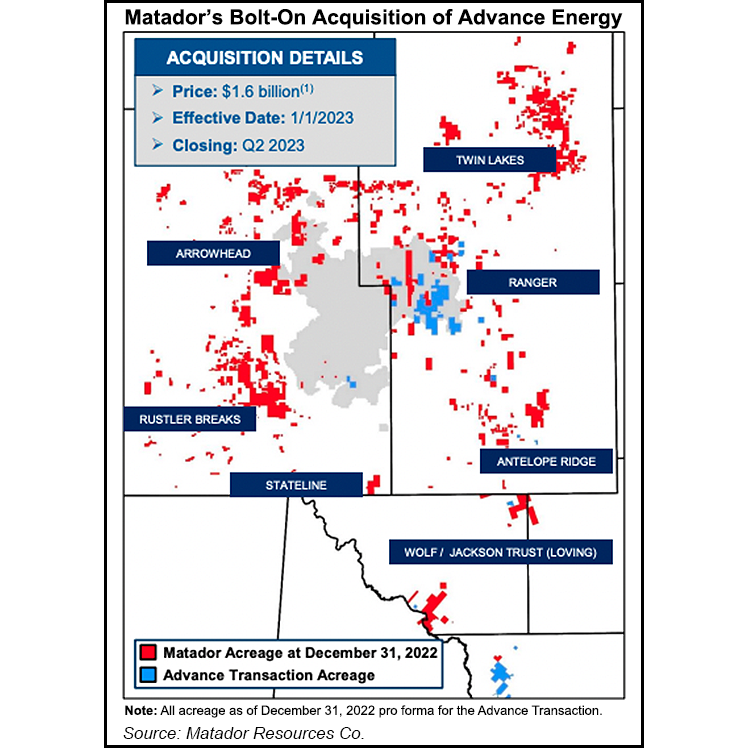

Matador Resources Co. has bolted on its largest deal yet in the Permian Basin in an agreement to acquire Advance Energy Partners Holdings LLC, with assets in New Mexico and West Texas.

The independent is providing an initial cash payment of $1.6 billion, with an additional $7.5 million total paid monthly in 2023 if the average West Texas Intermediate (WTI) oil price exceeds $85/bbl. On Tuesday, when the deal was announced, WTI was trading at $79.86/bbl.

“We have carefully managed and strengthened our balance sheet over time in order to be in a position for a special opportunity like this,” said CEO Joseph Foran. “I would say it’s more of a happy coincidence,” he told analysts during the conference call. “The company came to us and said, ‘Look, we think you’re the...