Natural gas futures jumped higher Tuesday afternoon after reports of a pipeline incident in Alberta broke up an otherwise quiet shoulder season day of trading. At A Glance: Production at 97.4 Bcf/d Weak spring season demand National Avg. back above $1 The May Nymex contract rose 4.1 cents day/day to settle at $1.732/MMBtu. Futures spiked…

waha

Articles from waha

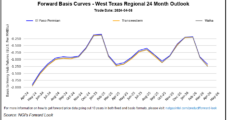

West Texas Natural Gas Exports to Mexico Surged in 2023 as U.S. Cemented Role as Top Global Supplier

Natural gas pipeline exports from the United States to Mexico via West Texas rose 20% year/year to average 1.6 Bcf/d in 2023, according to the latest data from the U.S. Energy Information Administration (EIA). Gas flows from West Texas to Mexico “have grown steadily since 2017 as more connecting pipelines in Central and Southwest Mexico…

Negative West Texas Prices Weigh Down Weekly Spot Natural Gas Average; Futures See-Saw

Despite bullish national production readings, weekly natural gas cash prices retreated alongside a West Texas supply glut and festering headwinds in the region. NGI’s Weekly Spot Gas National Avg. for the April 8-12 period lost 25.0 cents to $1.210/MMBtu. West Texas prices, as they did the prior week, proved the principal source of weakness. Waha…

As Demand Dissipates, Natural Gas Futures and Spot Prices Finish Trading Week with Whimper

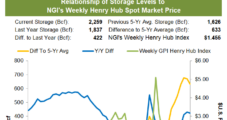

Natural gas futures were bound by a narrow range of gains and losses Friday. This capped a topsy-turvy trading week that featured falling production and an early rally, but also rapidly waning weather demand and choppy LNG activity that later sapped sentiment. At A Glance: Mild weather ahead Output near 99 Bcf/d Storage surplus holds…

APA Curtails Permian Natural Gas Output, Citing Negative Waha Prices

APA Corp. said Wednesday it curtailed about 35 MMcf/d of U.S. natural gas production during the first quarter, mostly during March. The curtailment was “in response to weak or negative Waha hub prices.” Waha is the hub of record for the Permian Basin, which spans West Texas and portions of southeastern New Mexico. Waha prices…

With Output Down and LNG Up, Natural Gas Bulls Extend Futures Parade; Spot Prices Slip

Natural gas futures advanced for a fourth consecutive session on Wednesday, with traders sharpening their collective focus on leaner production and recovering LNG export levels. These bullish factors countered weakening weather-driven demand and stout supplies in storage. At A Glance: Fourth straight prompt month gain Analysts anticipate modest injection Production hovers around 98 Bcf/d The…

Natural Gas Trims Early Gains as Market Eyes Storage Build Outlook — MidDay Market Snapshot

Natural gas futures, which had initially shown promising gains because of favorable production and export trends, remained only marginally positive at midday. Market focus shifted towards the upcoming storage report and the implications of mild weather forecasts. Here is the latest: May Nymex futures at $1.881/MMBtu as of 2:36 p.m. ET, up nine-tenths of a…

May Natural Gas Futures Rally for Third Day as Maintenance Compounds Production Pullback

Natural gas futures extended their winning ways on Tuesday, advancing for a third session amid lower production readings, signs of renewed LNG strength and bargain buying after a late-winter slump that spilled into the early spring. The May Nymex gas futures contract settled at $1.872/MMBtu, up 2.8 cents day/day. At A Glance: Production declines further…

Natural Gas Rally Loses Some Steam as Market Mulls LNG Outlook — MidDay Market Snapshot

After rallying early amid supportive fundamental trends, natural gas futures lost steam through midday trading. Market speculation around potential disruptions to LNG export traffic out of Corpus Christi, TX, may have played a role in tempering early gains. Here’s the latest: May Nymex futures trading at $1.873/MMBtu as of 2:30 p.m. ET, up 2.9 cents…

Weekly Natural Gas Spot Prices, Futures Uneven Amid Mixed Fundamentals

Weekly natural gas cash prices gained ground overall amid a rash of chilly northern temperatures, but pockets of weakness, particularly in West Texas, tempered the advance. NGI’s Weekly Spot Gas National Avg. for the April 1-5 period rose 16.0 cents to $1.460/MMBtu. As the trading week culminated, leading gainers included Michigan Consolidated, up 25.0 cents…