Kinder Morgan Inc. (KMI) expects domestic LNG export demand to more than double to 28 Bcf/d by 2030, Executive Chairman Richard Kinder said Wednesday.

“Given the situation in Europe today, which will result in more long-term contracts and the continuing usage in Asia, this hyper-growth scenario actually seems pretty reasonable to me,” Kinder told analysts during a call to discuss third quarter earnings. “That’s a huge increase, and most of it will occur in Texas and Louisiana, where so much of our asset base is located.”

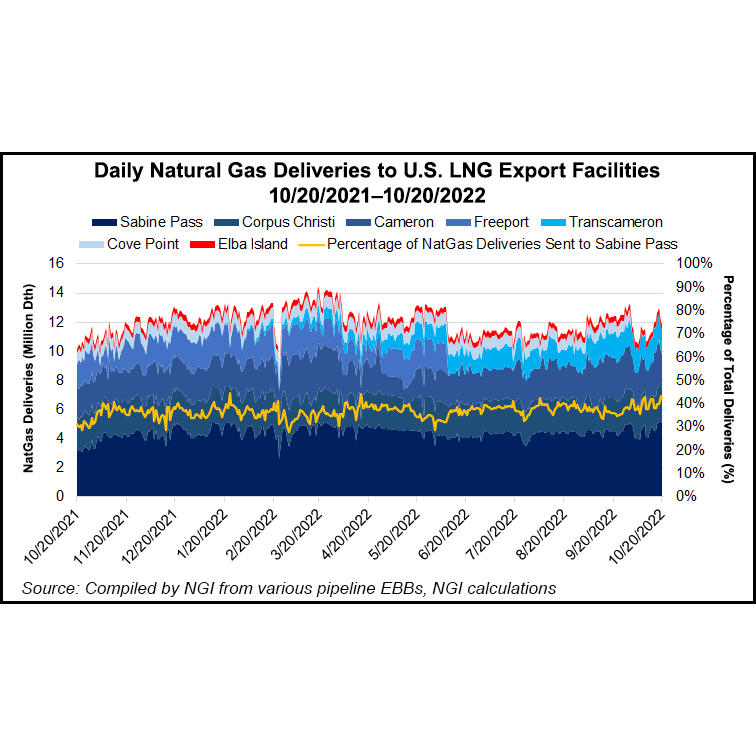

He cited that KMI currently moves about 50% of the gas consumed by U.S. liquefied natural gas export terminals, and “we expect to maintain or expand that share in the future.”

KMI is undertaking multiple projects to serve growing natural gas...