Japan expects to reduce its reliance on Russian liquefied natural gas (LNG) imports, but it’s unlikely to happen quickly, officials said.

The Group of Seven (G-7), an inter-governmental political forum, has been considering ways to punish Russia following its invasion of Ukraine. The G-7 consists of Canada, France, Germany, Italy, Japan, the UK and the United States.

If all of the G-7 countries were to “take simultaneous action to ban Russian LNG imports without securing alternative sources, the world economy, including the energy industry, will be thrown into chaos,” Japan’s Koichi Hagiuda, minister of Economy, Trade and Industry, said on an online meeting of the the G-7 leaders in early May.

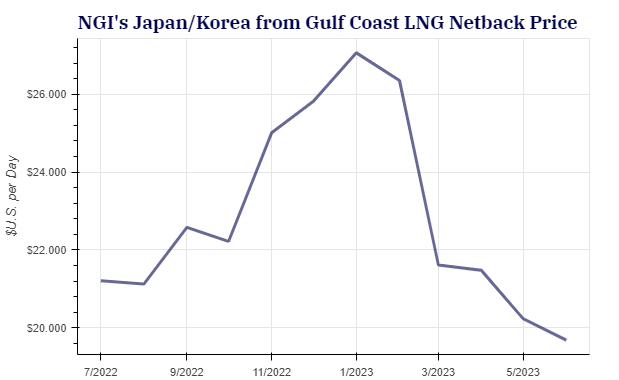

[Want to know how global LNG demand impacts North American fundamentals? To...