U.S. natural gas markets are looking dire for sellers, with futures diving near depths last seen during the Covid-19 pandemic. Several catalysts lie ahead, though, that could create a floor and set the stage for a rebound, according to analysts.

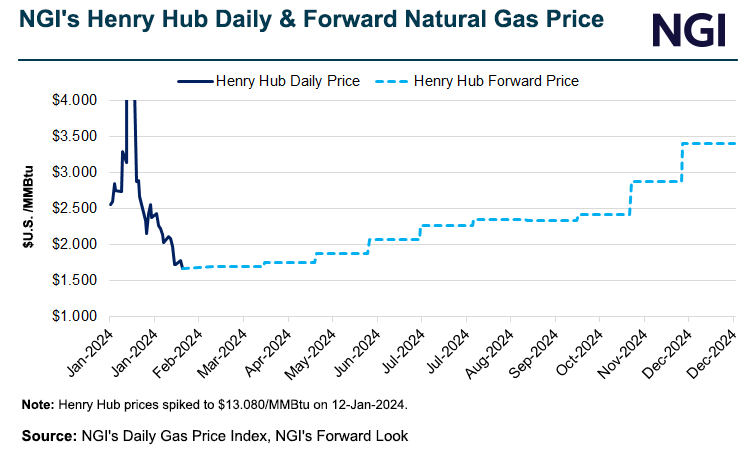

The March New York Mercantile Exchange (Nymex) contract fell below the $2.000/MMBtu level on Feb. 7 and hasn’t looked back, dropping in seven straight sessions, the latest on Wednesday, down 8.0 cents to $1.609. The contract traded as low as $1.590, within 11 cents of the lowest prompt-month close in the post-shale era of $1.482 in June 2020.

Meanwhile, NGI’s Henry Hub spot prices fell 15.5 cents day/day to average $1.510 on Wednesday. The benchmark cash price last touched this level in July 2020.

[Download Now: In our 2024...