LNG | LNG Insight | NGI All News Access

Gulf Coast LNG Operations Brought to Standstill as Hurricane Laura Looms

Even before it came ashore, Hurricane Laura had crippled liquefied natural gas (LNG) export capacity, shutting down the nation’s two largest facilities in Texas and Louisiana.

After Laura intensified Tuesday night, Sempra Energy’s Cameron LNG in Louisiana began implementing a “controlled shutdown” on Wednesday, said spokesperson Anya McInnis. A “ride-out team” of essential operations personnel was still expected to remain on site to handle any emergencies. Storm surge projections from the National Hurricane Center (NHC) on Wednesday showed a high likelihood of flooding over an area stretching from Freeport, TX, to Ocean Springs, MS, along a path where LNG facilities and a multitude of oil and gas infrastructure is sited.

Sempra joined Cheniere Energy Inc. in its decision to temporarily shut down its Sabine Pass terminal in Louisiana. Freeport LNG in Texas is also on high alert as it initiated its emergency response plan in anticipation of the storm.

Shipping had also come to a standstill as traffic was suspended at the Port Arthur, TX, Lake Charles, LA, and Houston Ship channels. No LNG vessels had loaded this week, said ClipperData’s Kaleem Asghar, director of LNG analytics. Asghar noted that there were four empty LNG vessels in the Gulf of Mexico sailing at a lower speed likely because of the disrupted export operations in Texas and Louisiana.

Nearly half a million residents were ordered to evacuate as Laura strengthened. The storm became “an extremely dangerous Category 4 hurricane,” the NHC said Wednesday. “Catastrophic storm surge, extreme winds and flash flooding” were expected along the northwestern Gulf Coast late Wednesday.

Producers, midstreamers and petrochemical companies also were preparing for the storm. Nearly 2 Bcf/d of offshore natural gas production has been shut-in, along with some volumes in South Louisiana and the Haynesville Shale, Genscape Inc. said.

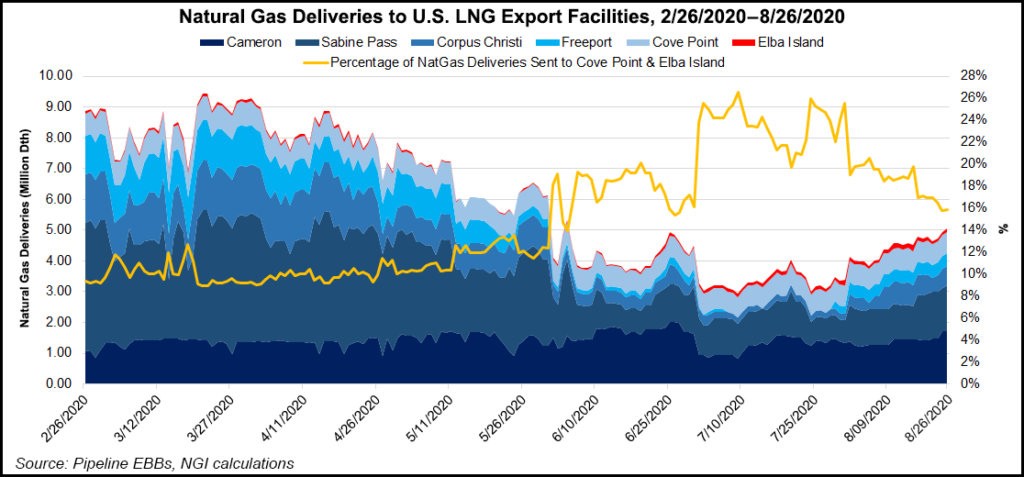

In all, total LNG feed gas nominations had slipped to 2.67 Bcf on Wednesday, down by 1.3 Bcf from Tuesday’s evening cycle and near an 18-month low, Genscape added. NGI’s U.S. LNG Export Tracker showed a similar drop early Wednesday with demand at 2.77 Bcf. The 2.35 Bcf/d Cameron Interstate Pipeline has issued a system-wide operational flow order noting that it could interrupt or discontinue service at any time given the hurricane. The system links the export terminal with five interstate pipelines.

Laura’s approach has pushed Henry Hub futures prices up in recent days. Given the increase and the prospect of lower exports, along with pipeline maintenance and increasing gas-fired power burn in Europe, key benchmarks there have hit “multi-month” highs this week, said Schneider Electric analyst Balint Balazs.

The Dutch Title Transfer Facility contract for September delivery was at $3.08/MMBtu on Tuesday, while the National Balancing Point was at $3.24 for the same period. Prices in North Asia were also stable as traders there were watching the hurricane closely.

Listen to the latest episode of our newest podcast NGI’s Hub and Flow via:

Episode 17: LNG Insight 2Q20 Earnings Takeaways – U.S. Cargoes Are Picking Up, Small Scale is Emerging

Some analysts, including EBW Analytics Group and Tudor, Pickering, Holt & Co., don’t expect Laura to have a lasting impact on the U.S. gas market. They cited marginal production shut-ins offset by LNG demand declines. Others predicted shorter-term problems could emerge.

Genscape noted that trading could be disrupted at Henry Hub in south-central Louisiana, the largest centralized physical point for natural gas spot and futures trading in the United States, as it has in the past. Most U.S. LNG purchases are linked to Henry Hub prices.

“Historically speaking, trading activity has been disrupted quite a few times in the past as flooding, power outages and mandatory evacuations have had a significant impact on the hub’s ability to operate,” Genscape said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |