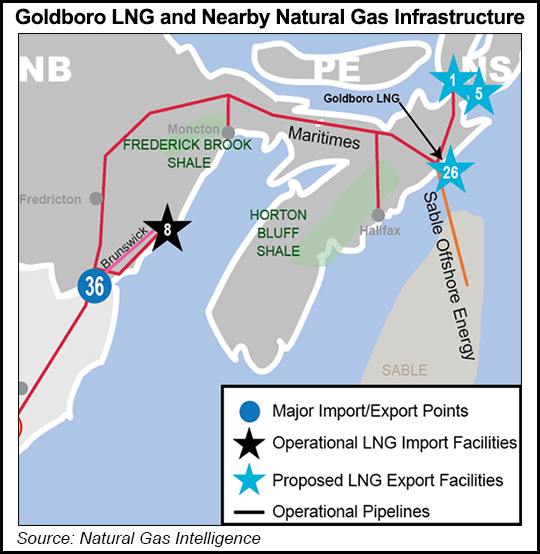

Nine years after announcing tanker shipments would start in 2018, the $10 billion plan for liquefied natural gas (LNG) exports from Canada’s Atlantic coast has secured road access to its terminal site but has not begun construction.

Nova Scotia Environment Minister Keith Irving granted the road permit for Goldboro LNG, and owner Pieridae Energy Ltd. filed information that explained the long delay.

The 75-page information form by Pieridae reported that only four of 12 project essentials have been achieved, with formidable obstacles remaining.

Uniper Global Commodities SE, the lone customer for the 4.8 million tons/year (625 MMcf/d) that the first half of Goldboro would pump out identified the essentials.

The Uniper contract, extended five times since it was signed in...