Gazprom Tells European Natural Gas Customers to Pay in Rubles

Gazprom PJSC said Friday it has sent notifications to certain customers requiring payments for natural gas be made in rubles.

The state-owned company, Russia’s largest natural gas producer, said on the messaging service Telegram that it was complying with a decree from President Vladimir Putin requiring “unfriendly countries” in Europe to pay in rubles after April 1.

“Gazprom, as a Russian company, unconditionally and fully complies with the requirements of Russian legislation,” the company said. “…Gazprom is a responsible partner and continues to reliably export gas to consumers.”

The announcement was the latest twist in Russia’s demands for ruble payments, which European leaders have rejected, saying they would breach contracts. Nearly all gas purchase contracts in Europe are denominated in euros and dollars.

Putin said in a TV address Thursday that European buyers would be required to open ruble accounts at Russian banks Friday or supplies would be cut off. At the same time, he said Russia would continue to fulfill its contractual obligations.

The outlook was clouded after the Kremlin told state news media that “unfriendly countries” could continue to pay for gas in foreign currency. Gazprombank JSC, which plays a key role in commodity transactions and was excluded from Western sanctions, would then convert the payments into rubles.

The Kremlin reportedly said Friday that supplies won’t be cut off immediately even if payments aren’t made in rubles as the cost of natural gas currently being delivered won’t be due until late April or early May, leaving time for European governments to review the Kremlin’s decree.

“Essentially, this is a deadlock,” said Rystad Energy analyst Vinicius Romano. “If buyers keep following the current contract rules, a unilateral halt in flows from Russia could lead to consequences for the supplier, as buyers may trigger the failure to deliver clause, opening up the possibility to claim penalties from Gazprom.”

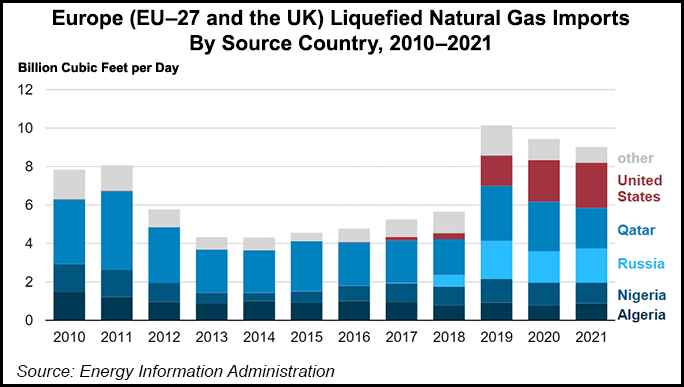

Meanwhile, fighting between Russia and Ukraine continues. The conflict has inflated European natural gas prices over fears that supplies could be interrupted. Russia provides about 40% of the continent’s natural gas imports.

Romano added that Russia does not currently have an alternative consumer market to deliver its natural gas to, “which implies that stopping flows would also stop income.”

Uncertainty surrounding Russian demands for ruble payments has pushed the Title Transfer Facility (TTF) contract up in recent days. Given the continued lack of clarity, that volatility is likely to continue as “all eyes are now on what will happen if a total stop for Russian gas exports do in fact become a reality,” said trading firm Energi Danmark.

Russian natural gas flows to Europe were again stable on Friday, when the market seemed to shrug off the ruble demands for the first time. The prompt TTF shed nearly $5 to finish closer to $36/MMBtu. Romano said the market appeared to be “digesting” what comes next.

Complicating matters Friday, Gazprom also said in a terse statement on Telegram that it was exiting its business in Germany.

The company said it had “terminated its participation” in Gazprom Germania GmbH and all its assets, including Gazprom Marketing & Trading Ltd. The company provided no other details. The subsidiary conducts natural gas storage, trading and transport operations in Europe.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |