Infrastructure | NGI All News Access | Regulatory

Flooding, EPC Co. Pullout Raise Doubts At Mexico’s Flagship Energy Project

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |

Haynesville Shale

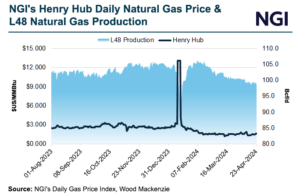

Natural gas exploration and production (E&P) companies in the Haynesville Shale continue to drive overall cuts to Lower 48 supply. Output there is down nearly 20% from a year earlier and continues to slide following well-telegraphed efforts to slow activity and balance an oversupplied market. Prices, however, have yet to respond, given a substantial supply…

April 26, 2024Markets

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.