Fitch Ratings Inc. has substantially raised its Henry Hub and European natural gas price assumptions through 2022, citing “strong year-to-date prices, recovering demand and supply challenges.”

“U.S. gas prices have…benefited from heightened weather-driven demand, as well as U.S. dry and associated gas production discipline,” the credit ratings analysts said, adding that liquefied natural gas (LNG) and Mexico export demand remained strong as well.

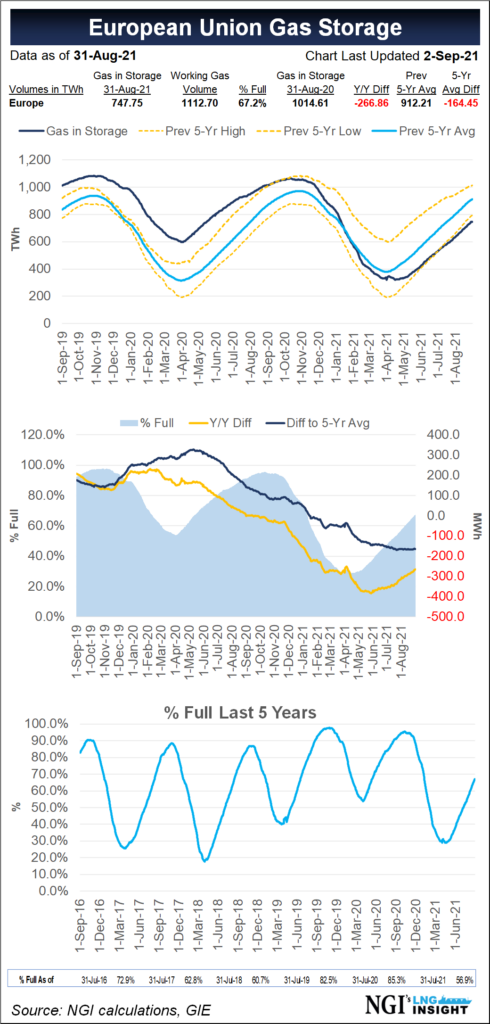

As a result, U.S. storage inventories are about 174 Bcf below the five-year average.

“We believe these factors will support pricing over the next 12-18 months, but expect a normalization of demand and potentially weaker producer discipline to result in a return to mid-cycle pricing in 2023 and thereafter,” the Fitch team...