A global oil supply glut and scant demand resulting from Covid-19 pushed ExxonMobil to a historic loss in the second quarter, with nearly every corner of its operations slammed.

The quarterly loss of $1.1 billion (minus 26 cents/share) was the deepest in history as transportation and petrochemical demand reversed. During 2Q2019, profits were $3.1 billion (73 cents).

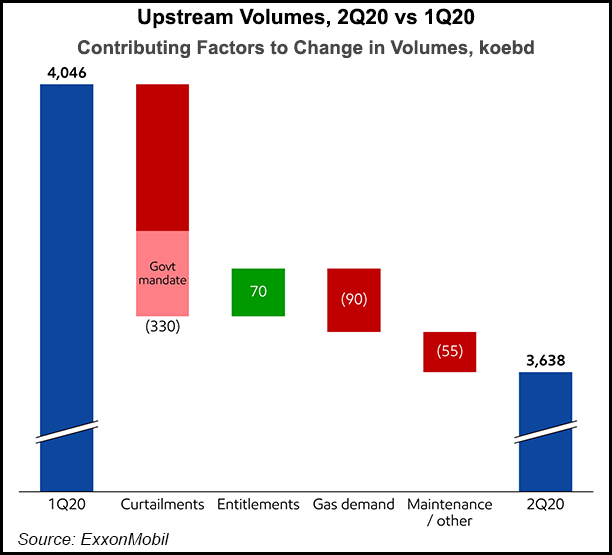

Liquids realizations fell by around 50%, with natural gas pricing down by 25%. Upstream losses plunged to $4.91 billion, compared with year-ago profits of $3.26 billion. U.S. losses were pegged at $1.53 billion, versus nearly $1.20 billion of losses in 2Q2019.

Supply is expected to exceed demand for months, “and we anticipate it will be well into 2021 before the overhang is cleared and we returned to...