LNG | Earnings | International | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

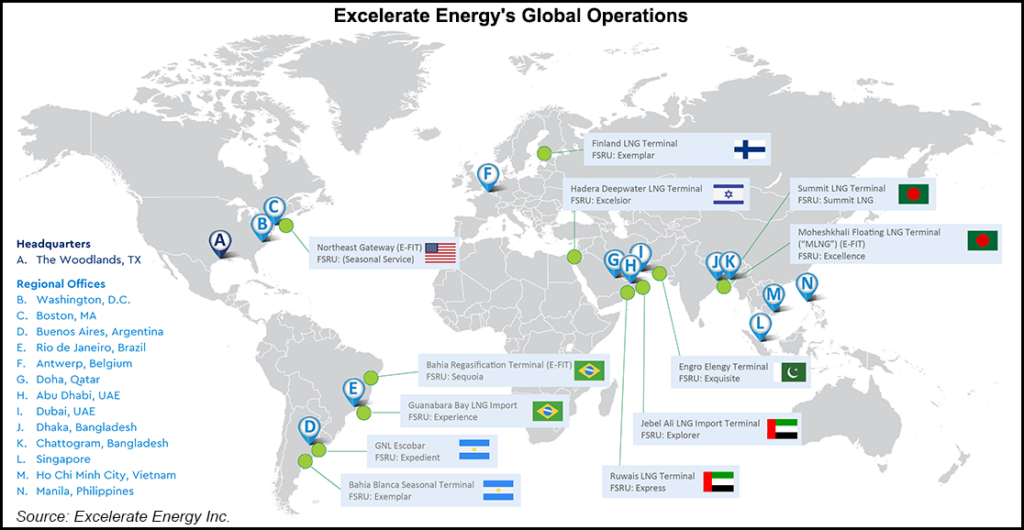

Excelerate Speeds to Fill Global LNG Gaps with Downstream Expansion

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |