Pioneer Natural Resources Co. will limit its net annual oil production growth to 0-5% even if the oil price hits $150, a possibility that CEO Scott Sheffield is not ruling out.

“I’m getting more and more confident about the long-term oil strip being much higher than we had expected,” Sheffield told analysts on Thursday during a call to discuss fourth-quarter and full-year 2021 earnings.

Nonetheless, “We’re not going to change…at $100 oil, $150 oil, we’re not going to change our growth rate,” Sheffield said. “We think it’s important to return cash back to the shareholders.”

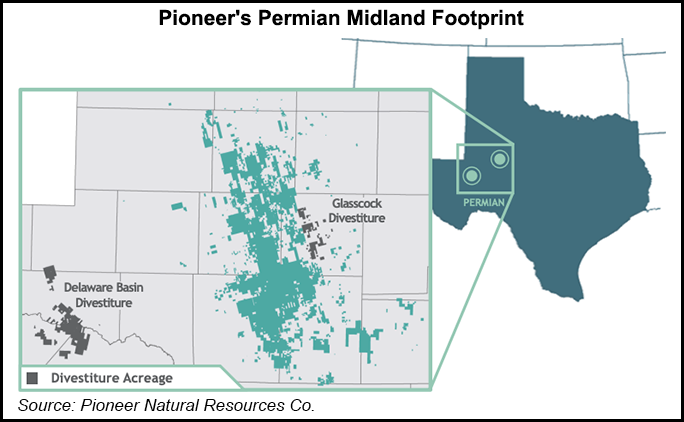

Irving, TX-based Pioneer is the largest operator in the Permian Basin, with operations increasingly concentrated in the Midland sub-basin.

Oil prices “could easily go to $150,”...