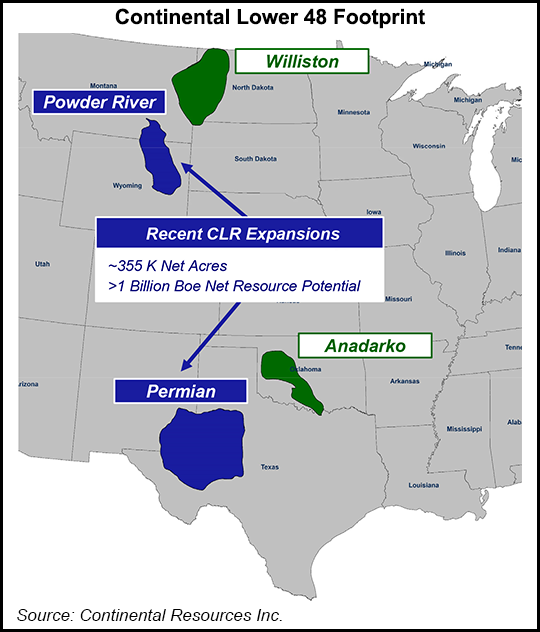

Continental Resources Inc. is expanding into the Permian Basin through an all-cash acquisition from Pioneer Natural Resources Co. valued at about $3.25 billion.

The assets in the Texas portion of the Delaware sub-basin are currently producing 55,000 boe/d with a 70% oil cut. They comprise more than 1,000 total locations, including more than 650 gross operated locations in the Third Bone Spring/Wolfcamp A and B formations

The assets span 50,000 net royalty acres and 31,000 net surface acres, and have extensive water infrastructure in place, according to Continental.

[Now Available: No-Code NGI Data Sync to Your Excel Spreadsheet – Get NGI’s New Excel Add-in. ]

“Continental’s foundation has always been built upon a strong geology-led corporate strategy,” CEO Bill Berry...