Natural gas isn’t going anywhere soon and overall demand for U.S. gas will keep growing on the back of rising exports, according to Mercuria Energy Co.’s Charles Blanchard.

Blanchard, head of North American natural gas research, recently published an exhaustive study on the history of natural gas in the United States called, “The Extraction State.” He spoke to NGI about the book, published by the University of Pittsburgh Press, in the latest episode of NGI’s Hub & Flow podcast.

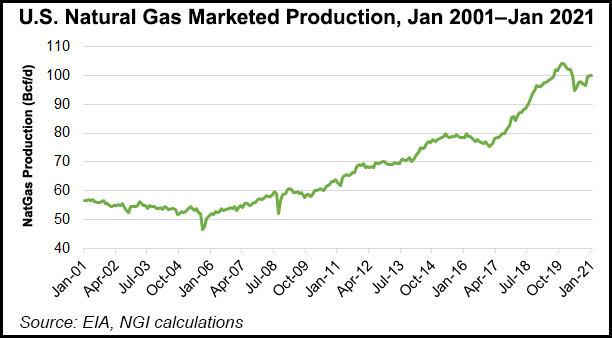

Blanchard suggested that demand for natural gas in the United States, which has grown since 1985, has probably reached its peak. New wind and solar power generation coming online outweighs retirements of coal and nuclear plants, which will squeeze natural gas market share.

In its latest...