Houston-based Coterra Energy Inc., created from a merger between Cabot Oil & Gas Corp. and Cimarex Energy Co., surpassed natural gas and oil production guidance in the second quarter, setting the independent up for higher-than-forecast volumes this year.

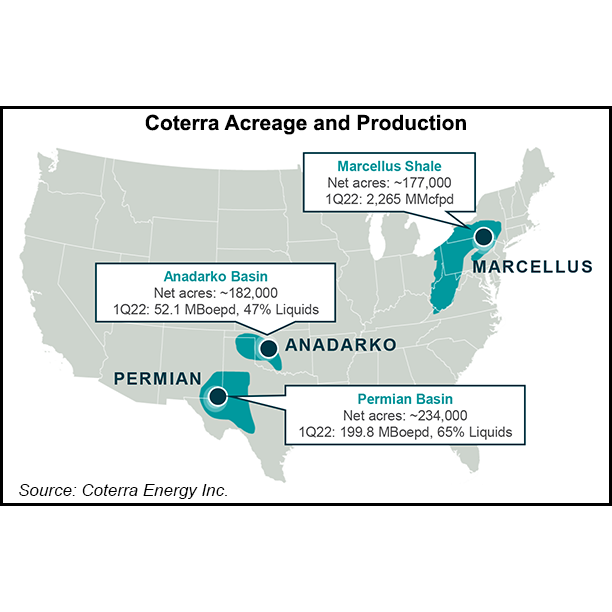

Total production from three Lower 48 plays – the Anadarko and Permian basins and the Marcellus Shale, was 632,000 boe/d in 2Q2022, above internal forecasts of 605,000-625,000 boe/d.

Natural gas output across the trio of plays averaged 2.79 Bcf/d, exceeding a forecast of 2.73-2.78 Bcf/d. Oil production also surpassed projections, averaging 88,200 b/d. Coterra noted that results for the first six months of 2021 reflected legacy Cabot figures, while the first half of this year referenced the combined company.

“While...