Regulatory | E&P | Infrastructure | Markets | NGI All News Access | NGI The Weekly Gas Market Report

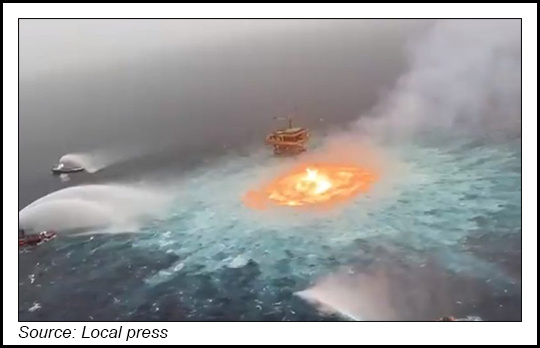

Column: Zama Ruling, Pemex Fire, LPG Company Part of Misguided Energy Policy

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |