Daily GPI | E&P | Infrastructure | International | Mexico | NGI All News Access | NGI The Weekly Gas Market Report

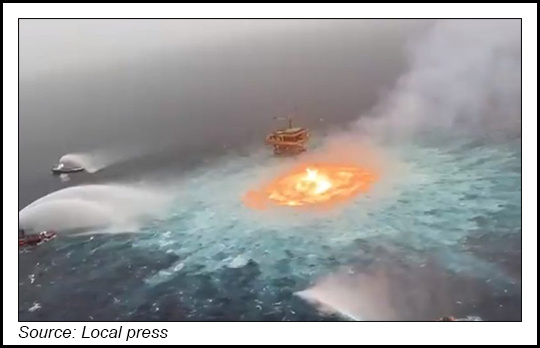

Mexico ‘Avoids Environmental Damage’ in GOM Fire while Talos to Explore Zama Decision

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |