Chevron Corp. continues to see lower demand for oil and natural gas from Covid-19, but it is focusing on what it can control, CEO Michael Wirth said.

The San Ramon, CA-based major issued its third quarter results Friday, highlighting the completion of its takeover of Noble Energy Inc. and the startup of some alternative energy ventures.

CFO Pierre Breber helmed a conference call with investors with downstream and chemicals chief Mark Nelson. Wirth did not participate, but said before the call that the company was keeping its eye on what it could control, i.e. “safe operations, capital discipline and cost management.”

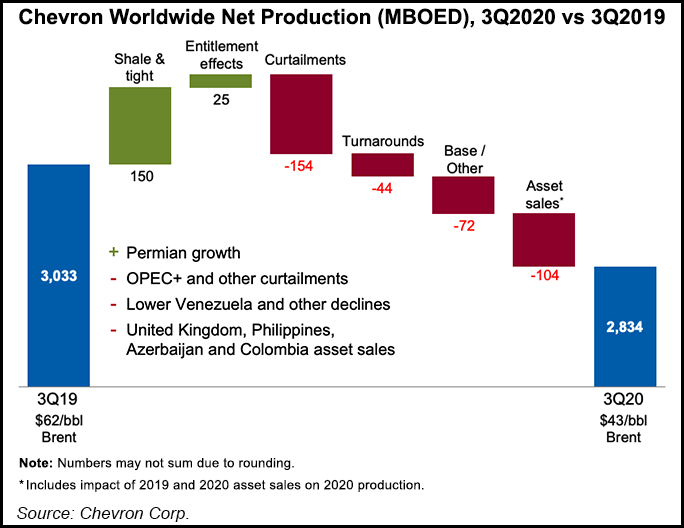

Organic capital expenditures were down 48% from 3Q2019, while operating expenses declined by 12%.

The acquisition of Noble was completed early in...