Setting up to be Colorado’s largest pure-play, Bonanza Creek Energy Inc. and Extraction Oil & Gas Inc. have agreed to merge in an all-stock transaction valued at around $2.6 billion.

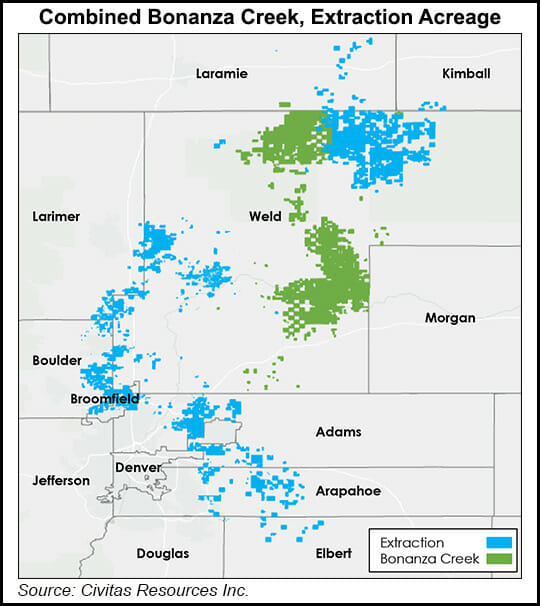

The combined exploration and production (E&P) company, to be called Civitas Resources Inc., would operate across roughly 425,000 net acres in the Denver-Julesburg (DJ) Basin.

Civitas would have a production base of 117,000 boe/d, weighted 40% crude oil, on a pro forma 1Q2021 production basis. These operations, according to the company, are geographically diversified across rural, “less regulatory-intensive areas,” as well as more prospective suburban acreage.

“Successful E&P operators will be those who place a priority on disciplined capital deployment, deliver operational and cost...