Jeremiah Shelor joined NGI in 2015 after covering business and politics for The Exponent Telegram in Clarksburg, WV. He holds a Master of Fine Arts in Literary Nonfiction from West Virginia University and a Bachelor of Arts in English from Virginia Tech.

Archive / Author

SubscribeJeremiah Shelor

Articles from Jeremiah Shelor

Forecasters Watching for Signs of Early December Cold as Natural Gas Futures Called Higher

December natural gas futures were trading 8.4 cents higher at $4.122/MMBtu shortly before 9 a.m. ET Friday, with forecasters pointing to milder medium-range trends and a long-range pattern that presents risks for more cold weather beginning later this month.

Eagle Ford Drilling Up as BHGE’s U.S. Rig Count Ticks Higher

The U.S. rig count increased by one to 1,082 for the week ended Friday (Nov. 16), driven by an uptick in oil-directed drilling, including gains in the Eagle Ford Shale, according to data from Baker Hughes, a GE Company (BHGE).

U.S. Drops One Natural Gas Rig; Oil Drilling Sees Small Increase

The U.S. natural gas rig count fell by one to 194 for the week ended Friday (Nov. 16) while an uptick in oil activity drove a small increase in the overall domestic count, according to data from Baker Hughes, a GE Company (BHGE).

More Volatility as Natural Gas Futures Rally on Long-Range Cold Risks, Storage Fears

Natural gas futures rallied Friday to close out a wild week, with forecasters pointing to long-range cold risks that served to exacerbate storage fears. In the spot market, a number of Northeast points gained on a wintry forecast as most regions sold off heading into the weekend; the NGI Spot Gas National Avg. fell 67.0 to $4.350/MMBtu.

Volatility Abounds for Natural Gas as Markets Jumpy on Cold, Storage Fears

The season’s first spell of legitimate winter cold delivered as promised for natural gas markets during the week ended Friday (Nov. 16), as the robust start to winter compounded concerns over storage deficits to send physical and futures prices soaring. TheNGIWeekly Spot Gas National Avg. jumped $1.170 to $4.565/MMBtu.

Long-Range Cold Risks Help Spark Natural Gas Futures Rally to Cap Wild Week

Natural gas futures rallied Friday to close out a wild week, with forecasters pointing to long-range cold risks that served to exacerbate storage fears. In the spot market, a number of Northeast points gained on a wintry forecast as most regions sold off heading into the weekend; the NGI Spot Gas National Avg. fell 67.0 to $4.350/MMBtu.

After Rapid Run Higher, December Natural Gas Called Lower on Overnight Warming Trends

December natural gas futures were down 26.9 cents to $4.568/MMBtu shortly before 9 a.m. ET Thursday as forecasts trended warmer overnight, easing some of the fear in a market made volatile by concerns over lean storage inventories.

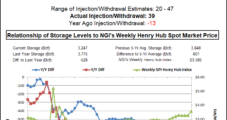

EIA Storage Report Misses Bearish as Weather-Focused Natural Gas Futures Swing Lower

The Energy Information Administration (EIA) reported a somewhat larger than expected 39 Bcf injection into U.S. natural gas stocks Thursday, giving bears further encouragement with a volatile futures market already pulling back sharply on forecasts.

‘Irrational’ NatGas Futures Reverse on Milder Trends, Plump Storage Build; Big Price Spikes Out West

Milder forecast trends and a larger-than-expected injection from the Energy Information Administration’s (EIA) weekly storage report saw natural gas futures reverse sharply Thursday from the lofty highs established during the previous session. Physical prices eased across much of the Lower 48 even as most points continued to trade above $4, while constraints sent SoCal Citygate and Northwest Sumas spiking; the NGI Spot Gas National Avg. climbed 3.5 cents to $5.020/MMBtu.

Milder Trends, Plump Storage Build Prompt Sharp Reversal in ‘Irrational’ NatGas Futures Market

Milder forecast trends and a larger-than-expected injection from the Energy Information Administration’s (EIA) weekly storage report saw natural gas futures reverse sharply Thursday from the lofty highs established during the previous session. Physical prices eased across much of the Lower 48 even as most points continued to trade above $4, while constraints sent SoCal Citygate and Northwest Sumas spiking; the NGI Spot Gas National Avg. climbed 3.5 cents to $5.020/MMBtu.