NGI Data | Markets | NGI All News Access

‘Irrational’ NatGas Futures Reverse on Milder Trends, Plump Storage Build; Big Price Spikes Out West

Milder forecast trends and a larger-than-expected injection from the Energy Information Administration’s (EIA) weekly storage report saw natural gas futures reverse sharply Thursday from the lofty highs established during the previous session. Physical prices eased across much of the Lower 48 even as most points continued to trade above $4, while constraints sent SoCal Citygate and Northwest Sumas spiking; the NGI Spot Gas National Avg. climbed 3.5 cents to $5.020/MMBtu.

Continuing a run of wild swings for a commodity that seemed hopelessly range-bound not so long ago, December Nymex futures tumbled 79.9 cents to settle at $4.038, trading as low as $3.973 on the way to giving up all of the gains from the prior session’s explosive 73.6 cent rally. For the rest of the winter strip, January tumbled 85.5 cents to $4.043, February dropped 87.3 cents to $3.897 and March fell 87.6 cents to $3.596.

NatGasWeather said based on recent moves it’s clear the market has become “completely irrational and dangerous if caught to the wrong side.” Midday weather data maintained milder trends observed overnight Wednesday into Thursday, but the data did not trend any warmer, according to the forecaster.

“A brief break between weather systems is still expected Nov. 22-24, which is considerably shorter in duration compared to what the data showed early in the week but was a touch milder the past two runs as well,” NatGasWeather said. “…Most of the weather data continues to see cold shots returning into the U.S. Nov. 26-29…although with important details in need of resolving as far as just how cold, which regions will be impacted greatest, and also what kind of breaks between cold shots should be expected.”

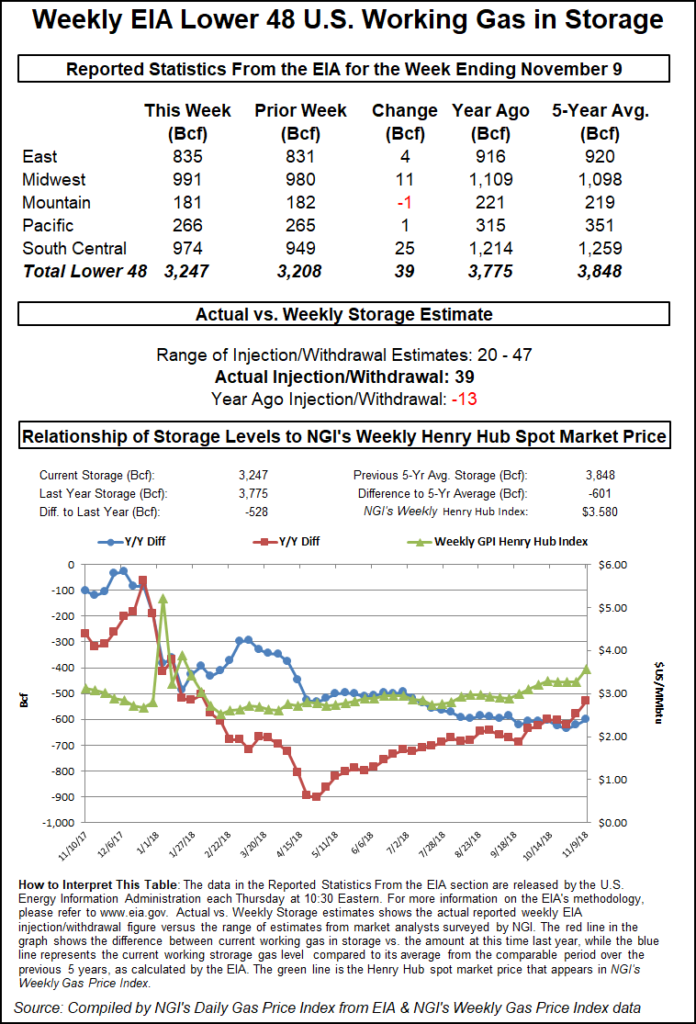

EIA reported a somewhat larger than expected 39 Bcf injection into U.S. natural gas stocks Thursday, giving bears further encouragement as the volatile futures market was already pulling back sharply on forecasts.

Warmer trends overnight heading into Thursday’s session had the December Nymex contract trading about 55 cents lower when EIA’s report crossed trading desks at 10:30 a.m. ET.

In the minutes following the report, the prompt month continued to trade around $4.240-$4.300/MMBtu. By 11 a.m. ET, the December contract had slid to around $4.133, down 70.4 cents from Wednesday’s settle.

The 39 Bcf build for the week ended Nov. 9 compares to a 13 Bcf withdrawal recorded a year ago, while the five-year average is a 19 Bcf injection.

Prior to Thursday’s report, major surveys had pointed to a build in the mid- to low-30s Bcf, with estimates ranging from 28 Bcf to 42 Bcf. Intercontinental Exchange (ICE) EIA financial weekly index futures had settled Wednesday at a build of 36 Bcf.

Prior to release of the report, Bespoke Weather Services said it had viewed risks as skewed lower.

“The market consensus seemed a bit lower too, so we see this number as still slightly bearish coming in above the consensus for a second week,” the firm said. “The build in the East was a bit of surprise, but otherwise the large salt build fit our expectations as we raced to fill storage ahead of the coming winter season.

“The market will likely shake this print off as the focus is much more on the large draw next week and latest weather forecasts. Yet what this confirms is with average weather the market is still decently well-supplied, indicating any normalization of weather can quickly push prices back below $4. Long-range blocking remains too significant to ease bullish risks, but this report should ease some fear.”

Total Lower 48 working gas in underground storage stood at 3,247 Bcf as of Nov. 9, 528 Bcf (14.0%) below last year and 601 Bcf (15.6%) below the five-year average.

By region, the South Central injected 25 Bcf for the week, including 19 Bcf into salt and 6 Bcf into nonsalt. The Midwest saw an 11 Bcf injection, while 4 Bcf was refilled in the East for the week. The Pacific posted a 1 Bcf net build, while Mountain region saw a net withdrawal of 1 Bcf, according to EIA.

Analysts with Tudor, Pickering, Holt & Co. (TPH) said their “bearish tone has not changed for 2019” following Thursday’s EIA report, as “we simply have too much gas coming to market.”

The forward curve suggests TPH’s outlook is shared by many in the market; the recent surge along the winter strip has not translated into any meaningful gains beyond the heating season, with April-December 2019 all settling well shy of $3 Thursday.

“The combination of early winter weather in 2018 mixed with pipeline delays has helped to set up a constructive inventory backdrop heading into year-end; however, the recent supply ramp in the Northeast (up 3.5 Bcf/d since June) and associated gas growth has shifted the market into weekly oversupply (about 3 Bcf/d weather-adjusted),” the TPH team said.

Over the next 15 months TPH sees demand — driven in particular by liquefied natural gas (LNG) exports — growing by 5 Bcf/d, but not enough to keep pace with projected supply growth of 7.8 Bcf/d over the same period.

“All signs point to prices needing to head lower,” potentially below $2.50/Mcf, in order to meaningfully slow supply growth, “especially in basins like the Haynesville Shale,” the analysts said.

In addition to low inventories for this point in the season, analysts with Jefferies LLC also pointed to a 1.5 Bcf/d year/year (y/y) uptick in power burns and a 4.1 Bcf/d y/y increase in LNG exports for the month of November so far to help explain this week’s rally. Higher residential/commercial demand in October also helped drive the gains, according to the analysts.

“Despite the spike in natural gas prices this month, power burn has remained strong at 24.7 Bcf/d month-to-date, up 0.4 Bcf/d versus the second half of October and up 1.5 Bcf/d y/y,” the Jefferies team said. “If this level of power burn continued through the end of the month, it would mark the highest November power burn on record. Given numerous coal plant retirements over the last several years, the power market is now more reliant on gas, limiting the ability of the market to switch back to coal.

“The last two times prices spiked to $3.50-plus, power burn pulled back almost immediately, falling by around 7 Bcf/d in January 2018 (warmer weather impacted this swing) and by around 800 MMcf/d in November 2016.”

On the supply side, dry gas production for November month-to-date has increased about 0.4 Bcf/d sequentially to 84.4 Bcf/d, a 7.8 Bcf/d y/y increase, the Jefferies team said.

“Permian production is down slightly sequentially (minus 160 MMcf/d) and has weighed on total U.S. supply over the last five days, driven by a rupture on the Sand Hills Pipeline (recent daily Permian flows are down over 1 Bcf/d),” according to the analysts. “Supply growth continues to be driven by the Haynesville (up 240 MMcf/d sequentially) and Appalachia (up 470 MMcf/d). Haynesville production has averaged 10.8 Bcf/d in November, which would be a new monthly high for the play (prior peak was 10.7 Bcf/d in November 2011).”

SoCal, Northwest Sumas Spike on Constraints

Northwest Sumas and SoCal Citygate — two locations in the West that have been prone to price spikes recently due to supply constraint issues — posted eye-popping gains Thursday coinciding with reports of additional pipeline restrictions impacting their respective markets.

Northwest Sumas — comprising deliveries into the Northwest Pipeline from Enbridge Inc.’s Westcoast system at the border between Washington state and British Columbia — traded as high as $100 Thursday on the way to averaging $55.305, a new all-time record. The previous all-time high average price there was $47.25 recorded in December 2000, Daily GPI historical data show.

There did not appear to be any clear demand catalyst driving Thursday’s premiums. Genscape Inc. was projecting demand in the Pacific Northwest to hover around 2.0 Bcf/d over the next several days, roughly in line with the prior seven-day average. Radiant Solutions was forecasting lows in Seattle Friday of 46, with temperatures expected to average around 4 degrees warmer than normal.

Northwest Sumas has experienced price spikes and traded at an elevated basis in the aftermath of last month’s pipeline rupture that has restricted flows on Westcoast.

“Westcoast has added a new unplanned maintenance event that has reduced Huntingdon Delivery Area capacity for Friday by nearly 292 MMcf/d,” Genscape analyst Joe Bernardi told NGI. “This event is a surprise because it wasn’t in any previous maintenance calendars. It’s disrupting Westcoast’s already reduced southbound flow to the Northwest Pipeline.”

Westcoast notified shippers late Wednesday that capacity through its Huntingdon Delivery Area would be restricted to 702,530 GJ for Thursday’s gas day, down from 1,019,802 GJ the day before.

Meanwhile, down in Southern California, SoCal Citygate — hindered by a number of ongoing import and storage restrictions — jumped $10.130 to average $18.615.

A planned three-day maintenance event starting Friday is expected to impact more than 500 MMcf/d of supply flowing into the Southern California Gas (SoCalGas) territory, according to Genscape’s Bernardi.

“The Wheeler Ridge Zone will be limited to a maximum of 147 MMcf/d for a planned relocation of the L225 pipeline,” Bernardi said. “This zone consists of three SoCalGas interconnects: with Kern River, with PG&E and with Elk Hills. Together these three locations have brought an average of 692 MMcf/d month-to-date, which would translate to a cut of 545 MMcf/d.”

A notice from Kern River earlier in the week pointed to potential re-route options at its other interconnect with SoCalGas at the Kramer Junction point, according to Bernardi.

“Kern’s month-to-date average deliveries there have been 535 MMcf/d, which would leave 20 MMcf/d of available capacity relative to SoCalGas’ firm operational capacity, and 173 MMcf/d relative to Kern’s maximum operational capacity of 708 MMcf/d,” the analyst said. “Even with reroutes, SoCalGas will likely need to increase storage withdrawals in order to meet demand this weekend. Genscape meteorologists are forecasting slightly colder-than-average weather for Southern California for the next several days.”

SoCalGas was forecasting system demand for Friday of just under 2.4 million Dth/d, down slightly from demand of around 2.5 million Dth/d on Wednesday. The utility was expecting weighted average temperatures on its system in the low 60s.

Meanwhile, ICE data for Friday and Saturday power deliveries showed peak prices at SP15 increasing by around $25 day/day.

Elsewhere, most locations across the Lower 48 eased off from elevated levels established a day earlier ahead of the arrival of wintry weather along the East Coast. Declines were steepest in volatile New England, where Tenn Zone 6 200L gave back $4.640 to average $5.425. Further south, Transco Zone 6 NY shed 78.5 cents to $4.330.

Chilly conditions over the central, southern and eastern United States Thursday were expected to moderate into Friday with a break between cold shots setting up, according to NatGasWeather.

“Although there is a weather system tracking out of the Southeast and up the East Coast, it’s milder compared to recent systems due to it coming from the South instead of out of Canada,” the forecaster said. “Another strong cold shot remains on track to impact the central, southern and eventually eastern U.S. this weekend through Tuesday or Wednesday of next week with another round of temperatures dropping 15-30 degrees below normal.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |