Carolyn Davis joined the editorial staff of Intelligence Press Inc. in Houston in May, 2000. Prior to that, she covered regulatory issues for environmental and occupational safety and health publications. She also has worked as a reporter for several daily newspapers in Texas, including the Waco Tribune-Herald, the Temple Daily Telegram and the Killeen Daily Herald. She attended Texas A&M University and received a Bachelor of Arts degree in journalism from the University of Houston.

Archive / Author

SubscribeCarolyn Davis

Articles from Carolyn Davis

‘Phenomenal’ Fracture Core Samples from Permian Test Site Called A Game Changer

The U.S. Department of Energy’s National Energy Technology Laboratory (NETL), working with the Gas Technology Institute, Laredo Petroleum Inc. and other industry partners, has collected what may be the world’s most comprehensive hydraulic fracturing research dataset in unconventional shale at a test site in the Permian Basin.

Freeport-McMoRan’s E&P Management Team Ousted

Freeport-McMoRan Inc., which spent more than $9 billion in late 2012 to build its U.S. oil and natural gas business, on Tuesday said the executive management team of its exploration and production arm has been sacked.

DCP Lays Off 10% More of Workforce, Cuts Spending

Denver-based DCP Midstream LLC, the largest natural gas processor in the country, has reduced its workforce by 10% and slashed capital spending for 2016.

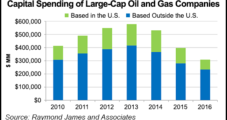

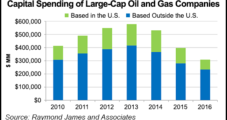

Global NatGas, Oil Capex Reductions at ‘Unprecedented’ Level, Says Raymond James

The global oil and natural gas industry has responded to the commodity meltdown with severe curtailments in capital spend, but the level of austerity implemented worldwide is unprecedented and undoubtedly will lead to a supply response, according to a survey of top-tier operators by Raymond James & Associates Inc.

Investment Firm Sued For Attempting to Influence Halliburton, Baker Merger

An investment firm that took $2.6 billion in stakes in Halliburton Co. and Baker Hughes Inc. after they had agreed to merge, with the intent to formulate merger strategies with the companies, was sued Monday by the Justice Department.

Raymond James Says E&Ps Focused on Lower 48 Cutting Capex Most

The biggest capital spending reductions in the global oil and natural gas industry are — no surprise — led by producers whose assets are concentrated in the Lower 48 states, Raymond James & Associates Inc. said Monday.

Private OFS Operators Holding On With Price Breaks, Layoffs, Compensation Cuts

The best customers are getting the best prices for services in the U.S. onshore, but those price breaks are cutting sharply into revenues for privately held companies, a new survey has found.

Falling NatGas Output, La Nina Possibly Fueling For Higher Prices by July

The warmest winter on record in the United States collapsed natural gas prices to the lowest levels since 1999, but by July prices could begin to rise, if “normal” weather prevails and production continues to slide, BofA Merrill Lynch Global Research said Thursday.

North American Producers Capture Nine of Top 25 Spots in Forbes Annual Ranking

Nine of the world’s 25 largest public oil and natural gas companies ranked by production are headquartered in North America, but ExxonMobil Corp. was squeezed out of the top spot by two Russian producers, according to an annual compilation by Forbes magazine.

Vanguard Deals SCOOP/STACK Properties to Titanium For $280M

Houston-based Vanguard Natural Resources LLC, which last year paid $1 billion-plus in an acquisition spree to acquire onshore properties, agreed Wednesday to sell some liquids-rich leases in Oklahoma’s stacked reservoirs to Titanium Exploration Partners LLC for $280 million.