E&P | M&A | NGI All News Access | NGI The Weekly Gas Market Report

Talos Snags More U.S. Deepwater Opportunities in Deals with BP, ExxonMobil

Houston-based Talos Energy Inc. said Thursday it has clinched agreements with BP plc and with ExxonMobil Corp. to expand exploration ventures in the deepwater U.S. Gulf of Mexico (GOM).

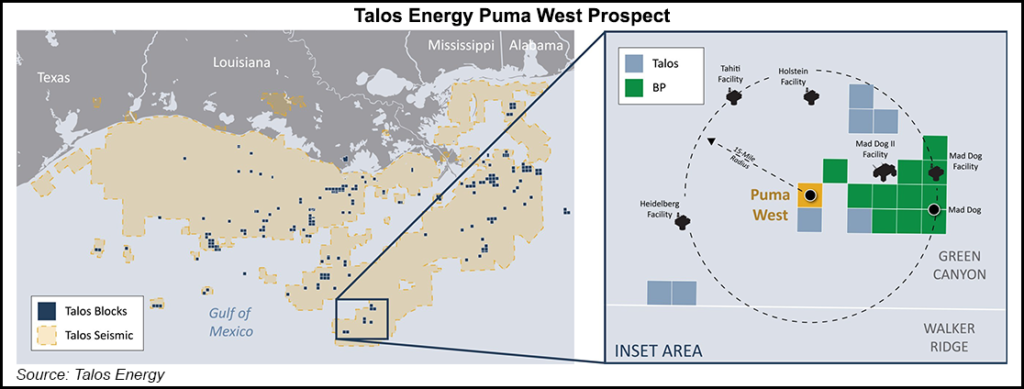

In the first agreement, BP would help evaluate and drill Talos’ Puma West prospect in Green Canyon (GC) Block 821. In the second deal, Talos acquired ExxonMobil’s Hershey prospect in GC blocks 326, 327, 370 and 371.

No financial details were disclosed. Talos’ inventory of prospects has long been centered in U.S. deepwater and Mexico blocks of the GOM.

“Our strategy of leveraging deep technical expertise across our extensive seismic database and our growing infrastructure footprint is applicable to both the acreage we acquire and control, as well as to third party acreage where we can execute on new opportunities,” said Talos CEO Timothy Duncan.

“As these transactions prove, Talos is well positioned to continue unlocking material resource opportunities in our basin through multiple creative business development avenues.”

On the Puma West opportunity, Talos would retain a 25% working interest, with operator BP holding the stakes. The initial exploration well is expected to be spud before the end of October using the Seadrill West Auriga ultra-deepwater drillship.

Puma West consists of sub-salt, Miocene target zones that may be similar to BP’s prolific Mad Dog field, less than 15 miles from the proposed well location.

The original Mad Dog spar has produced 230 million boe-plus since inception, and BP is now constructing the Argos platform for the Mad Dog II project, which would add 140,000 boe/d.

“Exploration of the Puma West prospect is a timely and material opportunity for Talos,” Duncan said. “While not scheduled in our original 2019 drilling program, by moving quickly, the company is able to work with a world-class operator in a potentially significant subsea tie-back project located on Talos acreage.”

In the agreement with ExxonMobil, Talos acquired all of the interest in the Hershey prospect and would operate the GC blocks, which cover about 23,000 gross acres.

According to Talos, Hershey is a large, sub-salt Miocene prospect with potential for several stacked horizons. Based on preliminary estimates, Talos said the prospect may contain oil-weighted, gross unrisked resources of 100-300 million boe, if the development proves successful. Hershey could be developed as a subsea tie-back or possibly with additional infrastructure.

“The acquisition of the Hershey prospect, located less than 10 miles from our Phoenix complex, adds another high-impact exploration opportunity to our portfolio that can leverage our nearby infrastructure and operating experience in the area,” Duncan said.

“The transaction structure, which is 100% contingent-based and contains no well commitment, provides Talos with significant financial and commercial optionality in evaluating the potential resource.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |