Eagle Ford Shale | E&P | NGI All News Access | Permian Basin

Anadarko’s Onshore Exploration Spending Set to Jump

Anadarko Petroleum Corp. is setting the wheels in motion to accelerate U.S. onshore drilling following the $2.64 billion cash sale for part of its offshore Mozambique natural gas project.

The Woodlands, TX operator agreed to sell a 10% interest to India’s ONGC Videsh Ltd. Anadarko would remain the operator and hold a 26.5% stake.

“We expect to use the net proceeds from this transaction to further accelerate the short- and intermediate-term oil and liquids opportunities we have in the Wattenberg field, Eagle Ford Shale, Permian and Powder River basins, as well as the Gulf of Mexico and other evolving plays in our portfolio,” said CEO Al Walker.

Anadarko’s U.S. onshore businesses helped to reverse losses in 2Q2013 year/year, and they drove production gains (see Shale Daily, July 31). Between April and June Anadarko invested $1.19 billion in the United States, most of its worldwide budget of $1.87 billion. Spending included $533 million in the Rockies and $383 million in the Southern & Appalachia unit.

The Rockies business includes stakes in the profitable Wattenberg field in Colorado, the Niobrara, Greater Natural Buttes and Wamsutter formations, as well as the Powder River Basin. The southern businesses include the growing Permian Basin and East Texas properties, while the Appalachia unit is focused on the Marcellus Shale.

“Our objective with this allocation of capital will be to further increase our cash-flow growth with attractive wellhead margins, while providing additional value to our shareholders as evidenced by our recent dividend increase and continued portfolio-management activities,” Walker said.

The sale “demonstrates our continuing ability to create substantial value through exploration and to again accelerate the value of our longer-dated projects through attractive monetizations and third-party capital.”

The sale is expected to be completed by the end of the year, pending approvals.

Tudor, Pickering, Holt & Co. (TPH) analysts said the sale was a positive, in part because Anadarko captured more for the stake than had been forecast. The selling price “implies $19.00/share asset value,” versus TPH’s estimate of $12.00/share. The operator “maintains a number of undervalued assets” and more sales “should help close the net asset value gap…”

Wells Fargo senior analysts David Tameron and Gordon Douthat said they didn’t know what Anadarko might capture in after-tax proceeds from the sale, but combined with $4.6 billion of cash on its balance sheet the debt-to-capital level appears to be under its “self-imposed 25% lower limit.

“This could mean that if it chooses, Anadarko could outspend 2014 cash flow and still maintain a very comfortable balance sheet,” meaning that the production growth rate “for at least 2014 and maybe 2015 moves from the prior year’s target of 507% to closer to 7-9%.”

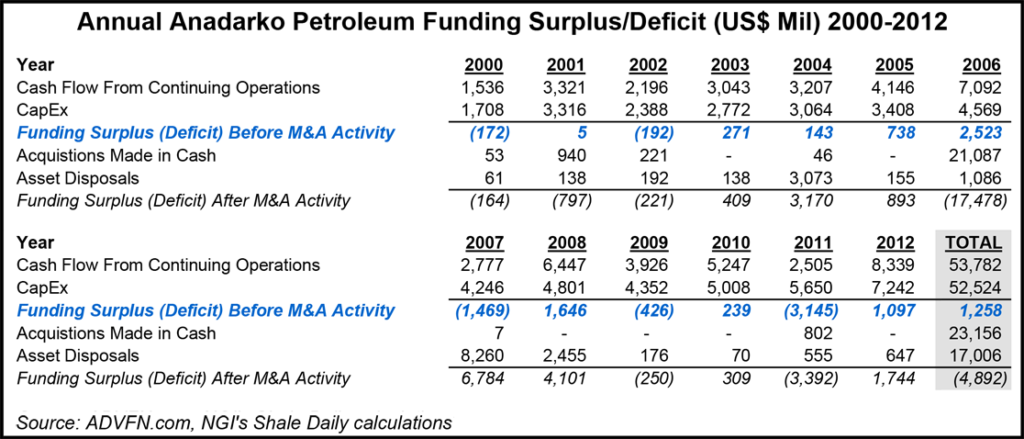

Anadarko tends to live within its cash flow over time. Between 2000-2012, the company generated $53.8 billion in free cash flow from continuing operations, and spent $52.5 billion in capital expenditures. That $1.3 billion positive differential shrinks to a negative $4.9 billion after accounting for cash outflows from net acquisitions, but the majority of that deficit was the result of Anadarko purchasing Kerr McGee and Western Gas Resources in 2006 for $21 billion in cash, plus the assumption of $2.2 billion in debt (see Daily GPI, June 26, 2006).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |