Markets | Natural Gas Prices | NGI All News Access

Hefty Withdrawal Expected from EIA Latest as Natural Gas Futures Rebound Early

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

Natural Gas Prices

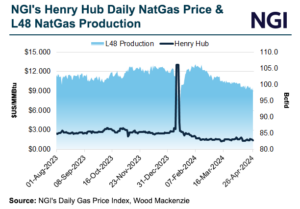

Nobody is questioning the downward direction of natural gas production over the past two months, a trend hastened by soft demand during a mild winter that put prices persistently near four-year lows. Major exploration and production (E&P) companies, including Chesapeake Energy Corp. and EQT Corp., announced curtailments to activity during the first quarter – cutbacks…

April 30, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.