M&A | E&P | Infrastructure | NGI All News Access

Rangeland Scoping Out Midstream Assets with EnCap Commitment

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |

Markets

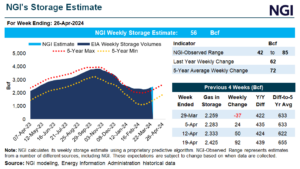

Natural gas futures pushed higher on Monday, boosted by a full restart of Freeport LNG’s third train, supply interruptions in the Permian Basin and expectations for a below-average storage injection. At A Glance: June takes over as front month Freeport restarts third train NGI models 56 Bcf injection The June Nymex contract settled 10.7 cents…

April 29, 2024Infrastructure

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.