NGI All News Access | Coronavirus | LNG Insight | Markets

LNG Weekly Recap: Coronavirus Continuing to Impact Demand Outlook

The outlook for liquefied natural gas (LNG) deteriorated on Monday, as the coronavirus continued to impact deliveries to China following a week in which the country’s largest importer declared force majeure and sent a bearish signal to an already oversupplied global market.

Ship brokerage and consultancy Poten and Partners said as many as 35 February cargoes could be subject to force majeure, with at least five already diverted. China National Offshore Oil Corp. (CNOOC) declared force majeure last week because of the virus and impacts to downstream demand. State-owned PetroChina and China Petroleum and Chemical Corp., aka Sinopec, had not yet declared force majeure but along with other importers in the country were first aiming to delay or divert cargoes set to arrive through April, Poten said.

According to ClipperData, there were two LNG cargoes floating near China on Monday, while another was near Malaysia. In another sign of disruption, Bloomberg reported that nine vessels were floating throughout Asia, citing data intelligence firm Kpler.

Total SA and Royal Dutch Shell plc rejected CNOOC’s force majeure, claiming the company doesn’t have cause. Other suppliers and trading houses have reportedly received notice from CNOOC.

PetroChina’s term suppliers are Qatargas, ExxonMobil Corp., Shell, Novatek and Cheniere Energy Inc. Sinopec’s term suppliers are Australia Pacific LNG and Papua New Guinea LNG, according to Poten, which added that about 47% of China’s LNG imports come from Australia. Only about three U.S. cargoes have arrived in China since last year because of an ongoing trade dispute, but the coronavirus has weakened a market that was flooded by natural gas.

Rystad Energy revised its growth estimate for Chinese LNG demand last week to 4.7%, versus a previous forecast of 10-13%. The firm noted that China currently has contracts to buy 50 million metric tons/year.

Spot prices in Northeast Asia fell further on Monday and remained below $3.00/MMBtu, while futures there and in Europe were trading around the same levels. LNG storage inventories in Europe were at 51% of capacity as of Saturday. Natural gas in underground storage there was also high at about 68% of capacity on warmer weather, well above the five-year average of 46%.

The arbitrage window between the Gulf Coast, Europe and Northeast Asia has closed, with maximum netbacks between those markets and U.S. export facilities just above Henry Hub prices, which have been mired in sub-$2.00 territory in recent weeks.

The dynamics could pose a problem for U.S. exporters over the summer if demand in Northeast Asia doesn’t improve and European inventories are so high during injection season that the continent can’t take in any more gas.

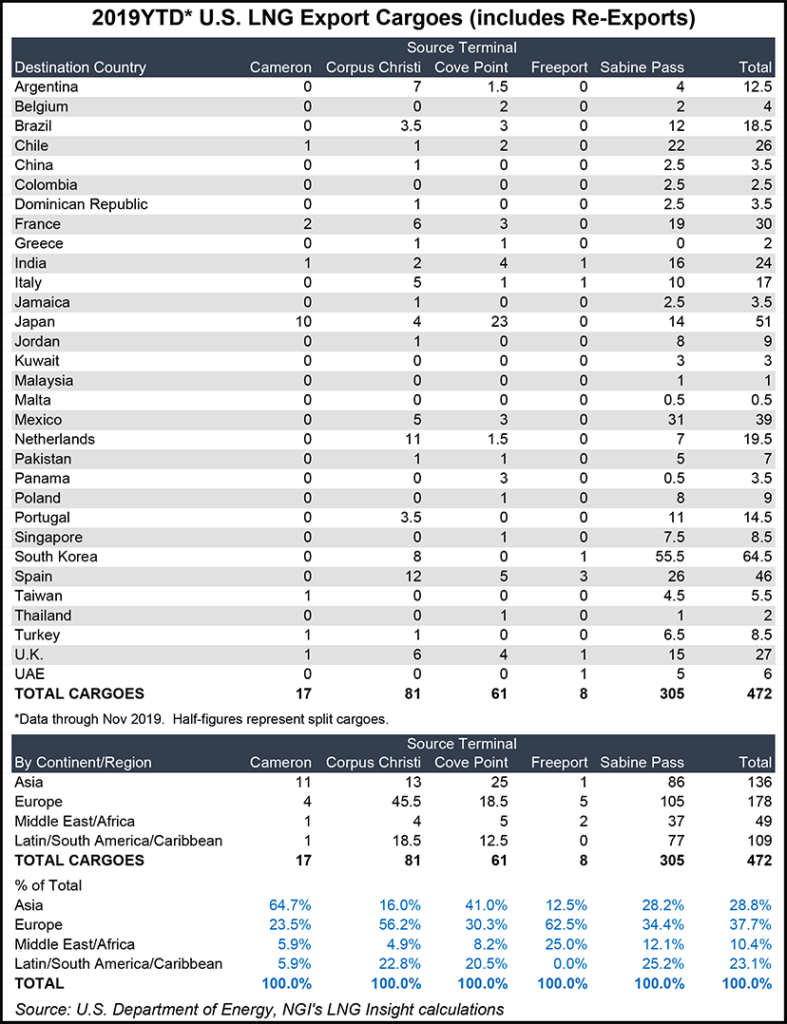

U.S. exports remained steady. Seventeen vessels, including eight from Sabine Pass, three each from Corpus Christi and Freeport, two from Cameron and one from Cove Point left the United States carrying 62 Bcf during the week ending Feb. 5. That’s compared to 21 ships that left U.S. export facilities in the prior week carrying 75 Bcf.

Elsewhere in the United States last week, the Pipeline and Hazardous Materials Safety Administration found that Alaska LNG meets siting requirements. The project, which is being developed by Alaska Gasline Development Corp., is backed by three Chinese companies, including Sinopec. The facility would export 3.5 Bcf/d from North Slope gas fields. A final environmental impact statement is expected from the Federal Energy Regulatory Commission next month.

In another supply region, a cyclone that made landfall in Western Australia on Saturday, threatening Gorgon LNG, NorthWest Shelf LNG and Pluto LNG, was downgraded by Sunday morning. Port terminals that import and export LNG and liquefied petroleum gas reopened on Monday.

An announcement from the United Arab Emirates last week could also heap more long-term pressure on global gas supplies. The country said it discovered the Jebel Ali field and estimated it holds 80 Tcf of gas reserves.

Genscape Inc. noted that the discovery boosts UAE’s effort to produce 1 Bcf/d by 2030 and would better allow it to meet its own demand needs and become a net exporter. UAE currently receives gas via pipeline from neighboring Qatar.

“Qatar’s potential loss of a downstream market could push extra volumes into the global LNG market,” Genscape said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |