NGI Archives | NGI All News Access

Bluegrass NGL Pipeline Proposal Inches Forward

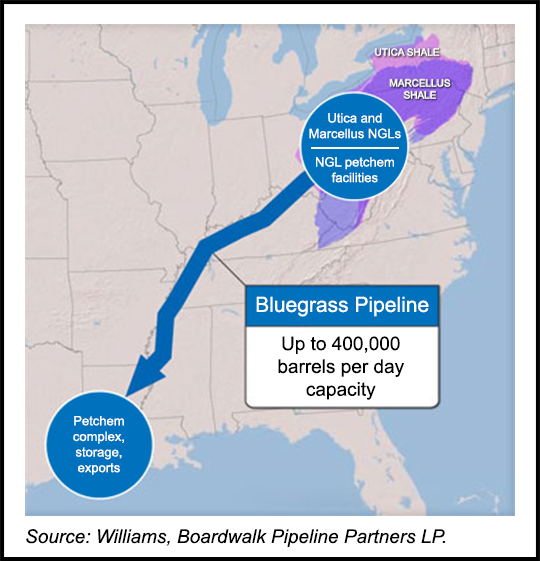

Bluegrass Pipeline, which if sanctioned would carry surging mixed natural gas liquids (NGL) from the Marcellus and Utica shales to Northeast markets and Gulf Coast petrochemical complexes, faces some hurdles before it would be sanctioned, the project partners said Tuesday.

An agreement to formalize and continue the development was reached on Tuesday by joint venture (JV) partners Williams and Boardwalk Pipeline Partners LP. Bluegrass, unveiled in March, would carry mixed NGLs to Texas and Louisiana facilities, and to Northeast markets (see Shale Daily, March 7).

In addition to the NGL line, a large-scale fractionation plant and Louisiana NGL storage are being considered. Williams and Boardwalk also are exploring a liquefied petroleum gas export terminal and related facilities that would be sited on the Gulf Coast that would offer access to international markets.

By combining new construction with an existing pipeline, the partners “believe that the Bluegrass Pipeline could be placed into service and begin serving customers sooner than other options.” Williams and Boardwalk management are working on project design, cost estimating, economic and risk analysis, customer contracting, permitting and regulatory approvals, as well as right-of-way acquisition. The proposed pipeline project could go into service in late 2015 if all the various details fall into place as expected.

“This timely joint venture with Boardwalk would link two liquids-rich resource plays in the Northeast U.S. with the expanding petrochemical industry on the Gulf Coast, providing producers in Ohio, West Virginia and Pennsylvania with the ability to access large and growing markets,” said Williams CEO Alan Armstrong. “The large scale solution has many advantages including an early in service date, lower environmental impact, lower cost and lower permitting risk.”

Boardwalk CEO Stan Horton said the pipeline project “provides an opportunity to leverage our liquids assets in the Lake Charles, LA area and repurpose a portion of Texas Gas without impacting our firm service to existing natural gas customers.”

Sanctioning and completing the project are subject to executing enough customer contracts and all of the required approvals, the partners said. Before the JV may begin converting a portion of the Texas Gas pipeline to NGLs, it has to receive abandonment authority from the Federal Energy Regulatory Commission. Boardwalk plans to file the abandonment application by Friday (May 31), a regulatory process that could take up to one year for approval or denial.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |