NGI Archives | NGI All News Access

Sinopec Builds Bigger Mississippian Position in JV with Chesapeake

China’s Sinopec International Petroleum Exploration and Production Corp. has added to its considerable leasehold in the Mississippian Lime formation after agreeing to pay Chesapeake Energy Corp. $1.02 billion in cash for half of its 850,000 net acres.

Chesapeake’s management team said last year it planned to sell some of its Mississippian formation (see Shale Daily, May 15, 2012).

Sinopec agreed to pay 93% of the total amount at closing, which is expected before the end of June. No drilling carries are involved, which means that all exploration and development costs are to be shared proportionately between the companies. The transaction was constructed differently from many of the joint ventures created today with foreign companies, which usually have paid for a drilling carry over a certain amount of time to help defray drilling costs for the seller.

However, Chesapeake would continue to operate the acreage and conduct all leasing, drilling, completion and marketing activities.

The transaction, said COO Steve Dixon, “moves us further along in achieving our asset sales goals and secures an excellent partner to share the capital costs required to actively develop this very large, liquids-rich resource play.”

In 4Q2012, net production from the leasehold averaged 34,000 boe/d, which was 208% higher year/year and 30% more than in 3Q2012 (see Shale Daily, Feb. 22). About 45% of total output in the final period was oil, and 46% was natural gas. Estimated proved reserves at the end of 2012 totaled 140 million boe net.

Chesapeake had 273 producing wells in the Mississippian at the end of December, including 55 that reached first production in the final quarter, compared with 73 in 3Q2012 and 49 in 2Q2012. Forty-six wells have been drilled but are not yet producing; they are awaiting completion and/or are waiting on infrastructure. Eight rigs now are running, a level that is expected to be the same through the year.

Chesapeake sold close to $12 billion of its onshore assets in 2012 and plans to sell up to $7 billion this year. The Mississippian leasehold has been on the list of acreage up for sale since last year.

Sinopec already has a foothold in the play, which stretches across portions of southern Kansas and northern Oklahoma. Last year a Sinopec unit invested $2.2 billion to acquire a one-third interest in five of Devon Energy Corp.’s onshore ventures, including a stake in its 210,000 net acres in the Mississippian (see Shale Daily, Jan. 4, 2012).

The latest transaction would provide Chesapeake with much needed cash to pay down its debt, but it’s not as good as some of the others in the Mississippian, said analysts at Tudor, Pickering, Holt & Co. (TPH).

In a note to clients Monday analysts said the deal was “negative relative to expectation…The deal is $200 million below our modeled assumption for similar acreage but more production,” which amounts to around 17,000 boe/d versus TPH’s model of 10,700 boe/d. “Netting off production, the undeveloped acreage appears to be worth between $750-1,000/acre.”

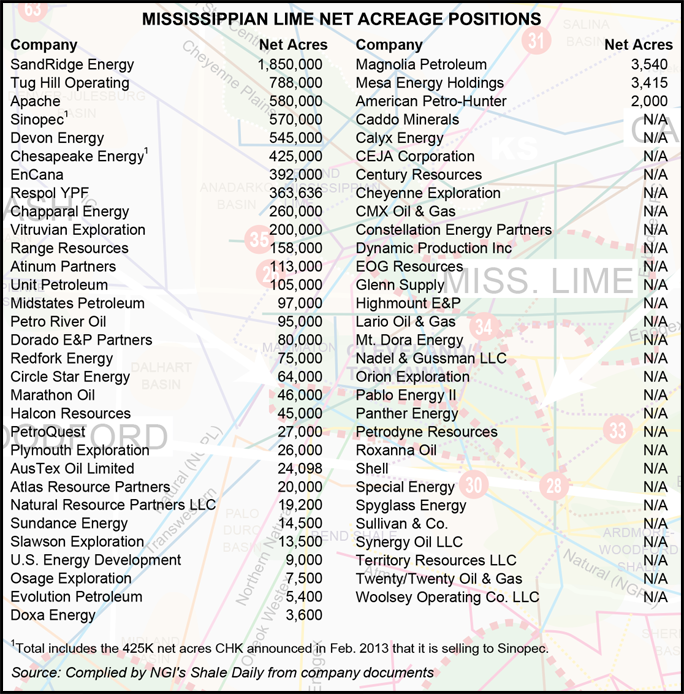

Chesapeake and Sinopec are each among the largest leaseholders in the Mississippian Lime, with only SandRidge Energy (1.85 million net acres), Tug Hill Operating (788,000 net acres) and Apache (580,000 net acres) holding larger positions than both companies, and Devon Energy (545,000 net acres) holding more than Chesapeake, according to company documents.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |