Natural Gas Prices | NGI All News Access | Shale Daily

With Stout Supply in Storage, Natural Gas Futures and Cash Prices Sell Off

Natural gas futures on Thursday fumbled away gains made earlier this week following a stronger-than-expected government inventory print and forecasts for benign weather and weak demand ahead.

At A Glance:

- EIA prints 24 Bcf build

- Production holds lower

- Weather demand fades

Following modest gains over the prior four sessions, the May Nymex gas futures contract on Thursday settled at $1.764/MMBtu, down 12.1 cents day/day.

NGI’s Spot Gas National Avg. shed 14.0 cents to $1.175, declining a second straight day amid negative prices in West Texas and softening consumption elsewhere.

Production held between 98-99 Bcf/d, down about 3 Bcf/d from the one-year average, according to Bloomberg data.

However, National Weather Service (NWS) data showed widespread mild conditions canvassing the Lower 48 on Thursday, with more of the same likely in store through late April.

At the same time, feed gas flows to Freeport LNG, after rising early in the week, fell at midweek amid ongoing maintenance work and interruptions. This left the market uncertain about the trajectory of repair and upgrade work at the Texas liquefied natural gas facility and, by extension, export demand through the spring maintenance season.

“Right now it seems like we have a battle” between “production drops” and “LNG struggles,” analyst James Bevan of Criterion Research LLC said Thursday on the online energy platform Enelyst.

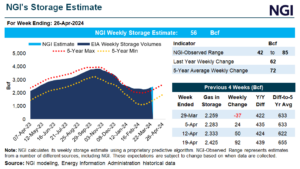

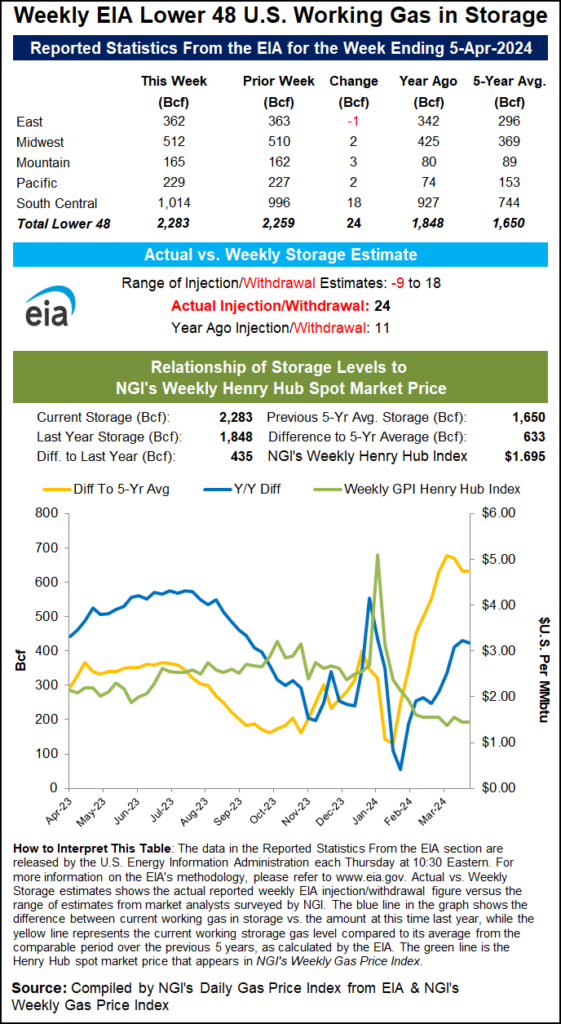

This left traders to fixate on Thursday’s U.S. Energy Information Administration (EIA) storage print, which proved bearish relative to market expectations. Utilities injected 24 Bcf natural gas into storage for the week ended April 5. That was on par with the five-year average but notably higher than poll estimates that coalesced around a low double-digit build. NGI modeled a 14 Bcf injection.

“Compared to degree days and normal seasonality, this week’s report is 1.9 Bcf/d loose versus the prior five-year average,” said analyst Eric McGuire of Wood Mackenzie. “This is a loosening of 0.9 Bcf/d week-over-week.”

The increase for the latest EIA period lifted inventories to 2,283 Bcf, putting stocks well above the year-earlier level of 1,848 Bcf and 38% ahead of the 1,650 Bcf five-year average. Storage proved plump throughout a mild winter.

The South Central injection of 18 Bcf led all regions. Mountain region stocks rose by 3 Bcf, while Pacific and Midwest inventories each increased by 2 Bcf. The East region posted a draw of 1 Bcf, according to EIA.

“The domestic natural gas market continues to struggle with a post-winter inventory overhang,” Mobius Risk Group analysts said. The recent gains ahead of Thursday were small. Bargain buying provided a boost, but overall, the market is laced with “a general sense of apathy.”

Looking ahead to the next storage report, analysts are generally expecting a solid build, though one that is shy of historical norms because of lower production readings this week. Early estimates for the week ending April 12 submitted to Reuters ranged from injections of 25 Bcf to 65 Bcf, with an average increase of 41 Bcf. That compares with a five-year average injection of 61 Bcf.

Farther out, however, anemic shoulder season demand could result in 100 Bcf or more builds and downward pressure on prices, EBW Analytics Group cautioned.

“Short-term considerations — including a steep week-over-week drop in heating demand next week, threats of a triple-digit storage injection, and a rebuilding storage surplus reawakening oversupply fears — offer downside threats for the front end of the Nymex curve,” said EBW’s Eli Rubin, senior analyst. “Despite brief optimism for a return of Freeport LNG earlier this week, nominations reverting lower similarly hint at lower price risks.”

Still, all is not lost for bulls. “Falling daily natural gas production scrapes indicate downside across the Haynesville, Permian and Northeast. If supply continues to fall, winter 2024-25 and 2025 contracts could be supported — even as current oversupply concerns suppress near-term pricing,” Rubin said.

Spot Market Malaise

As they did the day before, physical prices prodded lower on Thursday amid persistently poor conditions in West Texas.

Prices in the region ticked up on Thursday, but remained stymied deep in negative territory amid a supply glut amplified by maintenance work that compounded takeaway limitations in the region.

Prices at the Waha hub rose 9.5 cents but averaged negative $1.920, while El Paso Permian clawed upward by 12.5 cents but averaged negative $1.940.

Maintenance in the Permian Basin on Thursday also cut flows west to Arizona by 231.5 MMcf/d for the day. El Paso S. Mainline/N. Baja in the Southwest desert, however, fell 9.5 cents to $1.355 because of weak demand.

Elsewhere, price action was mostly to the downside across the Lower 48 due to mild weather. NWS forecasts called for rainy but mostly comfortable conditions through the weekend and deep into next week.

This included heavily populated California, where SoCal Citygate dropped 19.0 cents to $1.810.

In New England, meanwhile, Algonquin Gas Transmission maintenance work could impact supplies and cash prices over several days next week, Wood Mackenzie analyst Kevin Ong said. This could affect flows in Connecticut and Massachusetts.

Algonquin Citygate on Thursday lost 2.5 cents to $1.510.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 2158-8023 |