As traders looked ahead to a potentially supportive surplus-trimming government inventory report, natural gas futures probed above the $3.000/MMBtu level early Thursday.

The November Nymex contract was up 5.5 cents to $3.017 at around 8:50 a.m. ET. December was up 4.9 cents to $3.369.

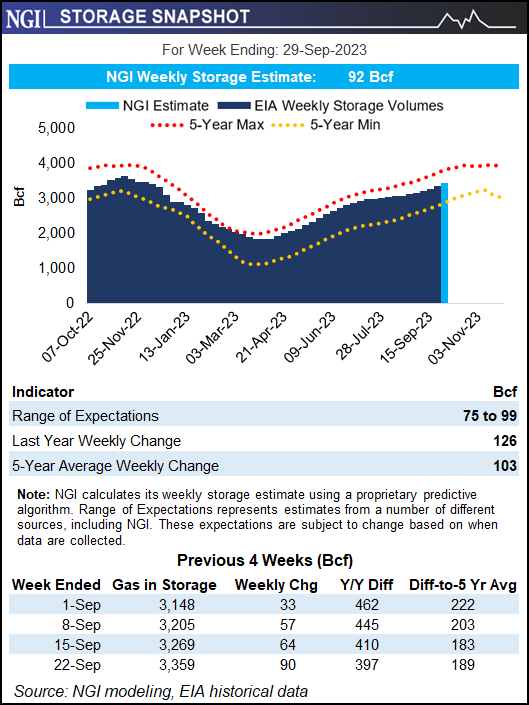

Estimates have the U.S. Energy Information Administration (EIA) revealing a lighter-than-average shoulder season injection in its latest weekly natural gas storage report, scheduled to hit the market at 10:30 a.m. ET.

NGI modeled a 92 Bcf injection for the report, which covers changes to Lower 48 inventories during the week ending Sept. 29.

Estimates submitted to Reuters spanned injections of 75 Bcf to 99 Bcf, with a median of 93 Bcf. A Bloomberg poll found a narrower range of 89 Bcf to 99...