Western Canada Shipping Less Natural Gas to U.S. Amid Improved In-Basin Pricing

Natural gas flowing from the Western Canada Sedimentary Basin to the western United States languished in April and May as higher prices north of the border kept supplies in the country, according to the U.S. Energy Information Administration (EIA).

The EIA said that Canadian imports through western pipelines fell to an estimated average of 6.2 Bcf/d in April and increased only marginally to an average of 6.3 Bcf/d in May. The projections were based on pipeline flow data from Genscape Inc. EIA noted that Canadian imports by pipeline into the western United States make up the bulk of imports and tend to be less seasonal than imports by pipeline in the eastern part of the country.

Though tepid demand resulting from Covid-19 is likely behind some of the reduced flows heading south, higher spot gas prices in Alberta, Canada, also led to the reduced exports.

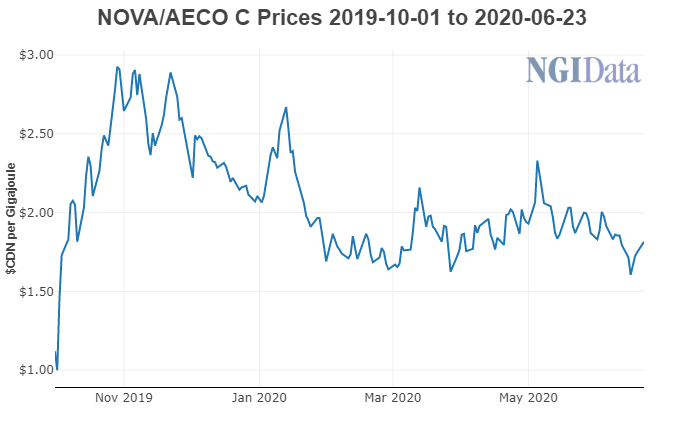

NGI data show that NOVA/AECO C spot gas prices consistently ranged between $1-2/MMBtu below Henry Hub from mid-2017 until late 2019. However, from October 2019-March, there was little difference in spot prices at those two points, with AECO even averaging 2.5 cents above the U.S. benchmark during that time.

U.S. natural gas pricing has benefitted from the recent pullback in oil activity, with reductions in oil production also leading to lower associated gas output. Furthermore, cheap gas prices have incentivized stronger power burns in the Lower 48, keeping a firm floor under the market.

Meanwhile, AECO price movements over the past several years reflect regulatory changes to Western Canada’s pipeline operations, according to EIA. In August 2017, TC Energy changed operations on its Nova Gas Transmission Ltd. system, prioritizing firm-service customers and stopping deliveries to interruptible customers, including storage operators, during maintenance periods. The change led to increased volatility and reduced injections into natural gas storage in Alberta, EIA said.

The Canadian Energy Regulator last September approved a temporary service protocol (TSP) for the Nova pipeline system, which allowed additional service flexibility during maintenance periods and, in particular, allowed deliveries to storage facilities during periods when the system is constrained. Shortly after the TSP approval, the difference between AECO spot prices and Henry Hub narrowed, EIA said.

These operational changes in Western Canada’s natural gas pipeline system and narrowing differences in spot prices have resulted in less natural gas being exported to the United States, especially at border crossings in Montana and North Dakota, according to the EIA. Natural gas imports in Montana and North Dakota in the first five months of 2020 averaged 0.4 Bcf/d and 0.3 Bcf/d less, respectively, compared with the first five months of 2019, it said.

In its most recent Short-Term Energy Outlook, the EIA projected that gross imports of natural gas by pipeline into the United States would fall to 7.0 Bcf/d in 2020 from 7.4 Bcf/d in 2019. Imports then are expected to increase to 7.9 Bcf/d in 2021. EIA’s forecast of 7.0 Bcf/d for this year would be the lowest level of annual U.S. natural gas imports by pipeline since the mid-1990s.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |