Markets | E&P | Infrastructure | LNG | Natural Gas Prices | NGI All News Access | NGI The Weekly Gas Market Report | NGL | Oil

Uncertainty is Theme of Latest STEO as EIA Models Falling Crude Prices in 2H2022

Brent crude oil prices will average $116/bbl in the second quarter, and Henry Hub spot natural gas prices will average $3.83/MMBtu over the same period, though events in Ukraine have clouded the outlook, the Energy Information Administration (EIA) said in updated projections published Tuesday.

In the March edition of its Short-Term Energy Outlook (STEO), the agency predicted a falling Brent oil price in the second half of this year (2H2022) and into 2023. The latest STEO modeled a 2H2022 oil price of $102 and a 2023 price of $89.

However, prognostication in the energy space is fraught with pitfalls in the best of times. Recent events have clearly made the task even more difficult, a fact EIA researchers acknowledged in a special statement released alongside this month’s STEO.

“We believe it is more important to understand all the factors generating uncertainty around our March STEO forecasts than it is to understand the forecasts themselves,” researchers said.

‘Greater-Than-Usual Uncertainty’

The Covid-19 pandemic had already created “greater-than-usual uncertainty” in EIA’s forecasting, and “this uncertainty has increased significantly following Russia’s further invasion of Ukraine,” according to the agency.

Among the key developments that could impact oil markets moving forward, researchers said nations besides the United States could ban imports of Russian energy or announce further sanctions. Independent actions by corporations could also impact Russia’s oil production, they said.

Meanwhile, producers not working in Russia could increase output in response to higher prices, according to the agency.

“In recent months, we have consistently forecast that global production of energy commodities such as crude oil will increase this year to balance demand that has increased more rapidly since mid-2020,” EIA researchers said. “We still forecast this.

“We expect global oil production in 2022 will increase to the point of beginning to restore depleted global inventories, which could contribute to some declines in crude oil prices. However, the Russian action in Ukraine and the global response to it make these forecasts highly uncertain.”

The crude prices modeled in the latest STEO are predicated on a projected 0.5 million b/d average increase in global oil inventories between 2Q2022 and the end of 2023. That rate reflects reduced oil production from Russia.

“However, if production disruptions — in Russia or elsewhere — are more than we forecast, resulting crude oil prices would be higher than our forecast,” researchers said.

Russia produced an estimated 11.3 million b/d in February. Under the STEO projections, output from the country would fall by 0.25 million b/d in March and another 0.5 million b/d in April.

Brent spot prices averaged $97 in February, an $11 sequential increase, EIA said. That was before the events in Ukraine sent prices spiking to nearly $124 in the first week of March, roiling a global market that was already experiencing “persistent upward oil price pressures” amid low inventories.

Global petroleum and liquid fuels consumption is set to average 100.6 million b/d for 2022 overall, a 3.1 million b/d year/year increase. Consumption is set to then rise to 102.6 million b/d in 2023 on average, EIA said. Researchers cautioned that the economic forecasting used in the outlook preceded the recent events in Ukraine.

“Oil consumption will depend on how economic activity and travel respond to recent and any potential future events and sanctions,” they said.

Is U.S. Natural Gas Production to Rise?

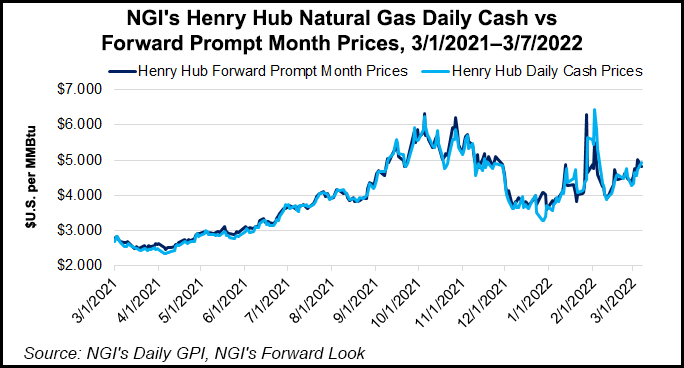

Meanwhile, EIA said it expects Henry Hub spot prices to average $3.95 for full-year 2022 before declining to $3.59 in 2023. Henry Hub averaged $4.69 in February, up from $4.38 in January, as inventory draws outpaced the prior five-year average for the month.

After freeze-offs impacted supply in February, the agency said it expects production to rise sequentially in March and put downward pressure on natural gas prices.

U.S. dry natural gas production averaged an estimated 95.3 Bcf/d in February, off 0.6 Bcf/d from January output. Production is expected to climb to 95.7 Bcf/d in March and reach 96.7 Bcf/d for full-year 2022. Production is on track to climb further to 99.1 Bcf/d on average in 2023, researchers said.

Domestic natural gas stockpiles ended February at 1.6 Tcf, and EIA predicted an end-March carryout of around 1.5 Tcf, 10% below the five-year average. Inventories are on track to end October at 3.5 Tcf, 4% below the five-year average, according to the latest STEO.

Domestic consumption is set to average 84.6 Bcf/d this year, up 2% from 2021 levels, reflecting higher industrial demand amid increased manufacturing activity, as well as colder temperatures year/year driving an uptick in residential/commercial demand. Higher renewable energy generation should reduce demand for natural gas in the electric sector this year, according to the STEO.

On the exports front, U.S. liquefied natural gas (LNG) exports averaged 10.9 Bcf/d in February, down from 11.2 Bcf/d in January, EIA said.

“Similar to last year, U.S. LNG exports in February were limited by fog in the Gulf of Mexico that affected vessel traffic and led to piloting services being suspended for several days on the Sabine Pass, Lake Charles and Corpus Christi waterways,” researchers said.

EIA said it expects U.S. LNG exports to average 11.3 Bcf/d for 2022 overall, a 16% year/year increase.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |