U.S. Supply Curtailments Could Return by 3Q if WTI Crude Prices Hold Near $40/Bbl

If current West Texas Intermediate (WTI) crude oil prices of around $40/bbl are sustained, all previously curtailed U.S. production would return by the end of September, according to Morgan Stanley researchers.

In a mid-year outlook issued Wednesday, the Morgan Stanley team, led by Equity Analysts & Commodities Strategist Devin McDermott, said the industry is in the first of a three-phase recovery. This first phase — reversal of curtailments — requires a WTI crude oil price of $25-30, while the second phase of production stabilization would require a WTI price of roughly $40 in order to hold 4Q2020 production levels flat. The final phase, according to Morgan Stanley, is the resumption of growth, which needs WTI prices to be around $40-50.

“With WTI now back around $40/bbl, pipeline flows suggest around 1 million b/d of curtailments have been reversed over the past few weeks,” researchers said. “If current prices hold, we believe effectively all curtailed volumes will return by the end of 3Q.”

On average, Morgan Stanley’s 2020 and 2021 WTI price outlook remains unchanged at $38 and $40, respectively, while its 2022 estimate is down to $42, versus $44 prior. Researchers see Henry Hub natural gas prices falling 10% to $1.94/MMBtu for 2020 and declining 3% to $2.65 in 2021. The team maintains their long-term assumptions of $42.50 WTI and $2.75 Henry Hub.

On Tuesday, the Energy Information Administration (EIA) updated its own price forecast, knocking down Henry Hub prices for 2020 another 11 cents from the previous outlook to $1.93. In the latest Short-Term Energy Outlook (STEO), EIA said it expects the Henry Hub price to average $3.10 in 2021, 2 cents higher than forecast in the previous STEO, as falling production levels continue to exert upward price pressures.

In a note to clients on Wednesday, Enverus said that after bottoming in May, natural gas pipeline data indicates that production has started to flatten, and in some areas, has shown gains. The pipeline sample, which represents 74% of the total gas produced in the United States, declined from 71 Bcf/d in January to 65.7 Bcf/d in May. As of June 23, production averaged 65.1 Bcf/d.

Pipeline scrapes show gas production June to date in some key plays trending higher compared to May, including in Appalachia and the Permian, Anadarko, Powder River and Williston basins.

“Despite these gains, production for the U.S. is still down in June,” Enverus analysts said. “However, it shows how U.S. operators can be resilient even during times when most of these areas are not economical.”

After plunging deep into negative territory in April, higher WTI prices have incentivized some producers to turn back on the taps. However, Enverus pointed out that this price level still leaves only a handful of areas with gas breakevens under $5/MMBtu, most predominantly in the Marcellus/Utica and Haynesville shales.

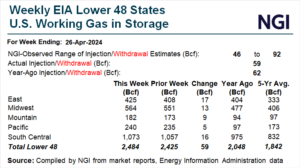

Nevertheless, the risk of ending the traditional storage season at “significantly” above-average levels is high, Enerverus said, due to expectations that demand destruction from Covid-19 mitigation efforts would initially outpace production shut-ins. Lower 48 inventories already are tracking well ahead of historical levels, sitting at 3.012 Tcf as of June 19, which is 466 Bcf above the five-year average, according to EIA.

However, by the start of the withdrawal season, and with production declines taking hold, storage inventories may decline rapidly as demand normalizes and the winter season gets under way.

“Using current forward prices as of June 24, inventories would reach a record low of -0.1 Tcf by the end of winter 2020-21,” Enverus said. The firm therefore expects a price response that would push Henry Hub to $3.90/MMBtu for winter 2020-21.

“This price response will affect forecasted production, power demand and liquefied natural gas exports in order to balance the market in summer 2021,” analysts said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |