Shale Daily | E&P | NGI All News Access

U.S. Oil ‘Curtailment Wave’ Forecast to Top 2 Million B/d in June

Public and privately held producers working across the United States are shutting in wells and cutting expenses at an accelerated pace since Covid-19 became a demand killer, and curtailed oil and liquids output is forecast to climb to “at least” 2 million b/d in June.

Rystad Energy analysts said the shut-ins have become a “curtailment wave” after exploration and production (E&P) companies initially began the process slowly in late March. With profitability and storage limits increasing, domestic output is coming down.

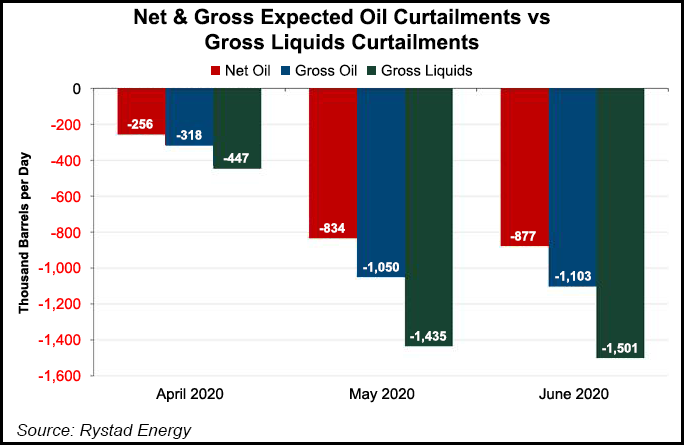

“Net oil production cuts could reach 835,000 b/d in May and 877,000 b/d in June, compared to around 256,000 b/d in April,” according to a Rystad’s initial analysis of 31 U.S. oil producers.

“This represents gross curtailments (including royalties to the government) of over 1 million b/d in both May and June, and at least 1.5 million b/d if total gross liquids output is considered.

“Adding the potential uncommunicated contribution from private and smaller operators, who are also likely to struggle, total Covid-19-related gross liquids output curtailments could easily hit at least 2 million b/d in June.”

Rystad’s analysis does not represent a total curtailment picture of U.S. output. Actual reductions “are probably larger and occur not only as a result of shut-ins, but also due to a natural decline from existing wells when new wells and drilling decline.”

Operators are using a combination of measures to reduce oil production, which include deferring wells put on production, moderating output from producing wells and temporarily shutting in lower-margin wells.

Some management teams have indicated during first quarter conference calls that they expect June curtailments may ease, depending on the prevailing oil price. Executives also have signaled that curtailed wells could return to pre-pandemic levels between July and September.

“Most operators specified that it will not take long before production can be fully restored from affected wells, as they aim to preserve reservoir and well integrity when moderating output or their wells,” said Rystad’s Veronika Akulinitseva, vice president of North American Shale and Upstream.

“In the end, the rather difficult situation at present is promising an accelerated transition for E&P companies. The U.S. shale sector is expected to become healthier, with strong companies becoming even stronger.”

Among the E&Ps highlighted by Rystad, diversified Lower 48 operator EOG Resources Inc. appeared to have pulled back output the most, by curtailing 125,000 b/d in May, or about 26% of 1Q2020 output, and 100,000 in June, or around 21%.

Denver-based Ovintiv Inc., another large diversified producer, has shut-in around 35,000 b/d net in May and June, or 22% of its first quarter output, Rystad noted. Continental Resources Inc. plans to curtail around 70% of oil production, with a 90%-plus cut in its No. 1 play, the Bakken Shale, the analysis showed.

Meanwhile, super independent Noble Energy Inc. “has curtailed around 7,500 b/d in May and plans to increase cuts to roughly 35,000 b/d in June, which is 30% of its 1Q2020 oil production,” analysts said. “Additional Permian-focused players have also come out with plans to cut output over the following months. WPX Energy Inc. has elected to cut 30,000 b/d over May and June, which is roughly 25% of its oil volumes.”

One of the largest Permian operators, Occidental Petroleum Corp., is forecasting about 45,000 boe/d of voluntary cuts in May, with 75,000 in June. “About a third of that will come from its U.S. portfolio, indicating around 15,500 b/d oil curtailment for May and 26,000 b/d in June,” said analysts.

In addition, Permian pure-play Centennial Resource Development Inc. “is cutting its oil output by 40% in May and June as a result of weaker realized prices, and will monitor the market and adjust its current strategy on a month-by-month basis.”

Global E&P Apache Corp., whose U.S. focus is trained on the Permian, is moving capital overseas and “has shut in about 2,500 higher-cost wells, which cumulatively produce around 7,500 b/d,” Rystad noted. “The company is confident that it can bring these wells back online in a timely manner should prices improve.”

In one positive, Cimarex Energy Inc., which operates in the Permian and Midcontinent, has decreased its production cut estimate. “While the company previously guided a 30% reduction in May, it is now cutting just 20% as a result of higher demand for oil from the marketing side than previously expected,” analysts noted.

In addition, several of the largest U.S. E&Ps including Hess Corp., Laredo Petroleum Inc. and Marathon Oil Corp. each indicated during first quarter calls that “as of now, they do not plan to curtail more production in the next few months.”

Hess, for example, has chartered three very large crude carriers, or VLCC, to store 6 million bbl of Bakken crude total in May, June and July, with plans to sell the barrels in the fourth quarter.

“In total, pure-play Permian and Permian-focused producers are driving 42% of the oil curtailments expected in June, as a high share of analyzed companies are focused in the Permian Basin,” Rystad noted.

“Diversified producers with activities spread across multiple plays are following close behind with a 35% share.” Of the diversified producers, around one-half of their portfolios are represented by the Permian’s Delaware sub-basin and Eagle Ford Shale, Rystad noted. “Bakken-focused operators cover 18% of the cuts,” with the rest spread among Niobrara/Powder River Basin and Eagle Ford producers.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |