Crestwood Equity Partners LP is expecting a one-off hit to its fourth quarter earnings because of extreme weather that caused well freeze-offs and production shut-ins across multiple Lower 48 basins, management said Wednesday. The harsh winter weather “adversely impacted volumes and well-connect activity across Crestwood’s gathering and processing assets during the quarter,” the Houston-based midstream…

Shut-Ins

Articles from Shut-Ins

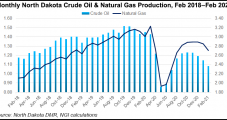

Bakken Shale Faces 400,000 b/d Shut-Ins from DAPL Closure

North Dakota’s Bakken Shale could experience up to 400,000 b/d of shut-ins for an interim period if a federal court hearing set for Monday results in the forced closure of the Dakota Access Pipeline (DAPL), the state’s chief oil and gas regulator said Thursday. Lynn Helms, director of the state’s Department of Mineral Resources, made…

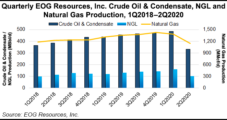

EOG Swings to Steep Loss as Coronavirus Crimps Demand, but Shut-ins Coming Back Online

Weakened commodity prices and lower production volumes dragged EOG Resources Inc. into the red in the second quarter, as the super independent pulled back on drilling and slashed capital expenditures (capex) in response to the demand destruction created by the coronavirus pandemic. The Houston-based company, which works in the Lower 48, Trinidad and China, said…

ConocoPhillips Reversing North American Curtailments, Monitoring Oil, Gas Prices

Houston-based ConocoPhillips has begun ramping up shut-in oil and gas volumes from across North America, with most output set to be “fully restored” in September. The largest independent in the world issued its second quarter results on Thursday, with CEO Ryan Lance sharing insight during a conference call. He acknowledged what many of his peers…

Montage Turning Shut-in Production Back to Sales as Crude, NGL Prices Increase

Appalachian pure-play Montage Resources Corp. said rising oil and natural gas liquids (NGL) prices have prompted it to bring back production curtailed earlier in the year, which has led to an increase in full-year guidance.

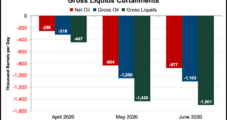

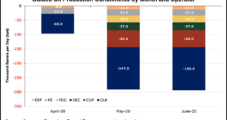

U.S. Oil ‘Curtailment Wave’ Forecast to Top 2 Million B/d in June

Public and privately held producers working across the United States are shutting in wells and cutting expenses at an accelerated pace since Covid-19 became a demand killer, and curtailed oil and liquids output is forecast to climb to “at least” 2 million b/d in June.

Bakken, Permian Seen Driving 300,000 b/d of Lower 48 Oil Supply Cuts Through June

The Williston and Permian basins are expected to drive at least 300,000 b/d of shut-in oil supply from Lower 48 operators during May and June, up from about 100,000 b/d of cuts projected for April, according to new analysis by Rystad Energy.

NGI The Weekly Gas Market Report

Global LNG Production Shut-Ins Seen Imminent as Prices Continue Falling

The outlook for liquefied natural gas (LNG) is growing dimmer as prices across the world have fallen by double-digits this year and the Covid-19 pandemic continues to ravage demand in markets already awash in supplies, suggesting production shut-ins are practically guaranteed in multiple countries.

NGI The Weekly Gas Market Report

U.S. Natural Gas Seen Moving Above $3 as Operators Shut-in Oil Wells

Domestic natural gas operators are beginning to regain control of the market and could see prices move “sustainably” above $3.00/Mcf as the U.S. oil supply declines, according to analysts.

NGI The Weekly Gas Market Report

U.S. Natural Gas Seen Moving Above $3 as Operators Shut-in Oil Wells

Domestic natural gas operators are beginning to regain control of the market and could see prices move “sustainably” above $3.00/Mcf as the U.S. oil supply declines, according to analysts.