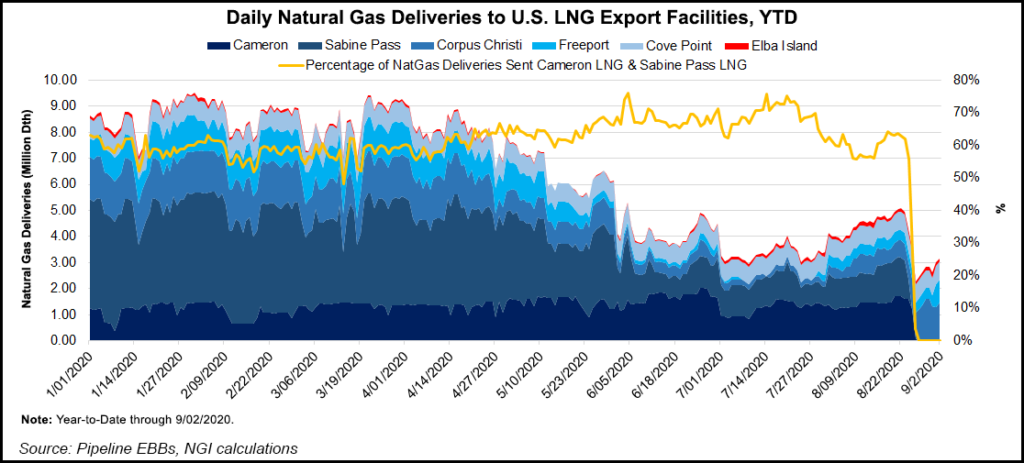

U.S. liquefied natural gas (LNG) exports will likely reach capacity of roughly 10 Bcf/d by the winter after dropping to about 30% of capacity in July because of the demand devastation caused by Covid-19, analysts told NGI this week.

Some analysts see capacity ramping through the end of the year, while others expect a sharp uptick as soon as next month.

“We’ve gone through the worst of it,” said Wood Mackenzie’s Alex Munton, principal analyst for Americas LNG. “I think clearly in terms of customers of U.S. LNG canceling cargoes because of the economics being unviable, that situation has changed.”

Asian and European gas prices were close to parity with U.S. gas prices for much of the summer, in the range of about $1.50-$2.00/MMBtu, he said. That caused long-term...