Oklahoma City-based independent Chaparral Energy Inc. has emerged from bankruptcy for a second time, this time as a privately held company. The Anadarko Basin-focused exploration and production (E&P) firm said it has equitized all $300 million of its unsecured senior notes due 2023, reduced its annual interest expense by more than $25 million and “significantly…

Topic / NGI Archives

SubscribeNGI Archives

Articles from NGI Archives

Dakota Access Secures Key Regulatory Nod to Ramp Up Bakken-Fueled Oil Capacity

The controversial Dakota Access Pipeline (DAPL) secured the final regulatory approval needed to build a pump station and expand others in Illinois, projects that should help it nearly double oil capacity. The Illinois Commerce Commission (ICC) this week approved Energy Transfer LP’s plan to build a pump station in Hancock County, IL, and expand other…

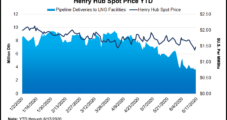

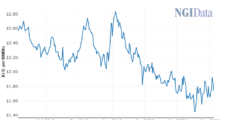

Natural Gas Forward Prices Driven Lower by Weak Cash; Heat Crucial to Sustained Recovery

With much of the supply/demand background fairly stable, weak natural gas cash pricing drove a deep dive lower for forward markets during the June 11-17 period, NGI’s Forward Look data show. Double-digit decreases extended across North America through the rest of summer, though smaller losses were seen further out the curve.

BP Impairing Up to $17.5B in Assets on ‘Enduring Impact’ from Covid-19 and Quicker Energy Transition

With an expectation that the energy transition away from fossil fuels may be sooner than expected, BP plc on Monday said it plans to impair up to $17.5 billion on the value of its assets for the second quarter because of limited upside in natural gas and oil prices.

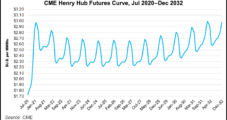

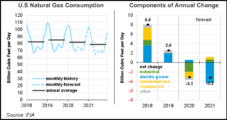

Rising Demand, Production Declines to Push 2021 Henry Hub Price to $3.08, Says EIA

Demand for natural gas is expected to increase next winter and production is expected to decline, causing upward pressure on prices and resulting in Henry Hub spot prices averaging $3.08/MMBtu in 2021, according to the Energy Information Administration (EIA).

Canada Still Tops for U.S. Natural Gas, Oil Trading, Even as Domestic LNG Exports Grow

Many U.S. natural gas and oil operators may view overseas demand as the best option for growth, particularly for liquefied natural gas (LNG), but Canada continues to be the largest source of domestic energy imports and the second only to Mexico for exports, the Energy Information Administration (EIA) said Friday.

NGI The Weekly Gas Market Report

Despite Uncertainty, Mexico Said to Remain Key Export Market for U.S. Natural Gas Producers

Even given the many unknowns related to the market impact of the coronavirus pandemic on both sides of the border, Mexico will remain a key destination for U.S. natural gas producers for years to come, according to analysts.

Higher Natural Gas Prices Said Critical to Haynesville Growth as Well Counts May Decline

The Haynesville Shale, the second largest dry natural gas producing area in the United States, is positioned for a 20% decline in output and activity to 2023 if Henry Hub prices were to maintain an average of $1.80-1.90/MMBtu, according to Rystad Energy.

NGI The Weekly Gas Market Report

DTE Sees Shoots of Growth for Natural Gas and Weathering Coronavirus Impacts

Even as DTE Energy is implementing cost-cutting measures to help navigate the economic downturn brought on by the coronavirus, the natural gas storage and pipelines (GSP) assets in the Lower 48 are creating a path for long-term success.

Q&A with John Padilla on Mexico’s Natural Gas Market Development — Bonus Coverage

Editor’s Note: Please enjoy this bonus coverage from NGI’s Mexico Gas Price Index, which includes daily prices, analysis and coverage of the emerging natural gas market in Mexico. NGI’s Mexico Gas Price Index, a leader tracking Mexico natural gas market reform, is offering the following question-and-answer (Q&A) column as part of a regular interview series with experts in the Mexican natural gas market.