American Midstream Partners LP (AMID) is selling its propane business to focus capital in the offshore Gulf of Mexico and onshore in the Permian Basin and East Texas, the partnership said Monday.

M&A

Articles from M&A

Hydro One’s $5.3B Takeover of Avista Extends Gas, Power Business from Canada into Northwest U.S.

Only two months after a privatization share sale, newly investor-controlled Ontario utility Hydro One Ltd. expanded Wednesday into the northwestern United States with a friendly takeover of Spokane, WA-based natural gas and power distributor Avista Corp.

Brief — Veresen-Pembina Merger

Shareholders of Calgary-based Veresen Inc. have approved a pending C$7.3 billion merger with Pembina Pipeline Corp., which would create one of Canada’s largest midstream energy infrastructure companies. The transaction,announced in May, is scheduled to close this summer. The combined operations would span natural gas, byproducts and oil markets in Canada and the United States from Fort St. John in northern British Columbia to Chicago.

Cantium Stocks GOM Arsenal with Chevron’s Shallow Water Assets

Privately held Cantium LLC, formed last year, is stocking its shelves with some of Chevron Corp.’s shallow water assets in the Gulf of Mexico (GOM), including the Bay Marchand and Main Pass properties.

Baker Hughes, GE Merger Official, Kicks Off ‘New Era’ For OFS

Billing itself as “the world’s first and only fullstream oil and gas company,” Baker Hughes Inc. and GE Oil & Gas announced Monday that their mega-merger — estimated at $32 billion — is complete.

Brief — Shell Energy North America

One of North America’s leading natural gas marketers, Shell Energy North America (SENA), has agreed to buy MP2 Energy LLC for an undisclosed price. MP2 manages power plants and delivers retail power to end-use customers. Subject to regulatory approvals, the transaction should be completed in 3Q2017. SENA now manages a retail energy business targeting large commercial and industrial customers on the U.S. West Coast. With the purchase of MP2, which is headquartered in The Woodlands north of Houston, SENA plans to expand operations in Texas and through the eastern United States. SENA’s North American gas sales volumes are estimated at around 10 Bcf/d. According to NGI’s top natural gas marketers for 1Q2017, SENA was ranked No. 2.

EQT’s $8 Billion Buyout of Rice Energy Would Create Largest U.S. NatGas Producer

EQT Corp. has agreed to buy out Appalachian competitor Rice Energy Inc., an estimated $8 billion transaction that would create the largest natural gas producer in the country.

House Panel Passes 11 Energy Bills; One Sets $10M Threshold for Some M&A

The House Committee on Energy and Commerce (E&C) Committee on Wednesday passed 11 bills covering energy infrastructure and efficiency matters, including one bill that would set a $10 million minimum threshold for mergers and acquisitions (M&A) subject to FERC jurisdiction.

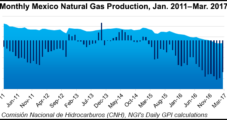

Mexico Natural Gas Production Declines; Pipeline Issues Could Spell Summer Shortages

As temperatures rise in what promises to be a hot summer in Mexico, the country’s production of natural gas — the fuel of choice for the nation’s power plants — has been dropping by 10% year-on-year in recent months.

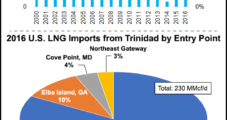

Shell Buying Out Chevron’s T&T Stakes in Gassy Offshore Fields, LNG Company

Royal Dutch plc is expanding its natural gas-rich holdings in the Republic of Trinidad and Tobago (T&T) after agreeing to buy Chevron Corp.’s interests in the strategic twin-island Caribbean nation.