Dallas-based Matador Resources Co. flagged initial test results from three Permian Basin wells in Lea County, NM, which in aggregate over 24 hours flowed 7,856 boe/d, consisting of 7,172 b/d of crude and 4.1 MMcf/d of natural gas.

Topic / Haynesville Shale

SubscribeHaynesville Shale

Articles from Haynesville Shale

Brief — Azure Midstream Partners

Dallas-based Azure Midstream Partners LP, affiliates and certain subsidiaries filed for Chapter 11 bankruptcy in U.S. Bankruptcy Court for the Southern District of Texas. The company said it anticipates filing a motion to approve procedures for a sale of all or substantially all of its assets, as well as a Chapter 11 plan and accompanying statement shortly. The company said it has reached an agreement on the process with lenders. Day-to-day operations are expected to continue until a sale. The company has assets in Louisiana and Texas, including in the Haynesville Shale and Cotton Valley. “…Chapter 11 reorganization is the only solution that maximizes going concern value for all stakeholders,” said CEO Chip Berthelot. “We will continue to operate the company and proceed through this process in a way that best preserves asset value for everyone with an interest.” These bankruptcy filings do not involve Azure’s parent company, Azure Midstream Energy.

Enterprise Execs Give Nod to ‘Sleeper’ Eagle Ford, Comeback Haynesville

The Permian Basin might be getting most of the rigs, and most of the press, but the Eagle Ford Shale is a “sleeper,” and rigs keep trickling back to the Haynesville Shale, too, Enterprise Products Partners LP executives said during a conference call Monday.

Haynesville Did Comstock Proud in 2016; 20 Wells Planned This Year

Comstock Resources Inc. credited its Haynesville Shale drilling program for a 47% increase in proved reserves achieved last year.

Range Resources Reports Encouraging Results From North Louisiana Extension Wells

Range Resources Corp. said Friday that three test wells drilled to the south of proven acreage it recently acquired in North Louisiana show the kind of long-term potential management had hoped for to move forward with development of new fields.

Briefs — Goodrich Petroleum

Goodrich Petroleum Corp. has participated in two Haynesville Shale wells in Caddo Parish, LA, that have reached a combined 24-hour peak rate to date of 72,000 Mcf/d. The company owns a 17.4% working interest in each of the wells, which came online in the middle of December. As previously announced, Goodrich has established a preliminary capital expenditure budget for 2017 of $40 million, which will be concentrated in the core of the Haynesville Shale in North Louisiana. The budget contemplates 12-16 gross (three to four net) wells for the year, with plans to commence drilling operations on the Wurtsbaugh 26-14-16 1 Alt well by early February. Goodrich said it has entered into a natural gas hedge through a costless collar of $3.00-3.60 for 12,000 Mcf/d for calendar year 2017.

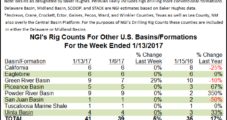

U.S. Land Rigs Fall, But Declines Modest Across Plays

The U.S. land-based rig count dropped for the first time in about two months during the week ending Friday, Jan. 13.

Comstock Partnering With USG Properties on Haynesville Acreage

Comstock Resources Inc. said it and USG Properties Haynesville LLC have struck a joint development agreement for acreage prospective for the Haynesville Shale in Louisiana and Texas. The acreage was recently acquired by USG.

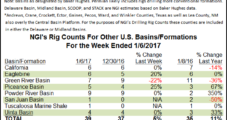

Rigs Keep Rising, Followed by Oilfield Services Rates

A modest six land-based rigs returned to service in the United States during the week ending Friday, according to Baker Hughes Inc. That was enough to push the current tally to 640, five rigs past the year-ago level. More rigs are coming back this year, and that will mean increased pricing power for oilfield services companies, analysts said.

Chesapeake Agrees to Second Planned Haynesville Sale For $465M

Chesapeake Energy Corp. said Tuesday that it has agreed to the second of two planned divestitures of noncore assets in the Haynesville Shale, selling 41,500 net acres to an affiliate of Dallas-based Covey Park Energy LLC for $465 million.