E&P | Haynesville Shale | NGI All News Access

Rigs Keep Rising, Followed by Oilfield Services Rates

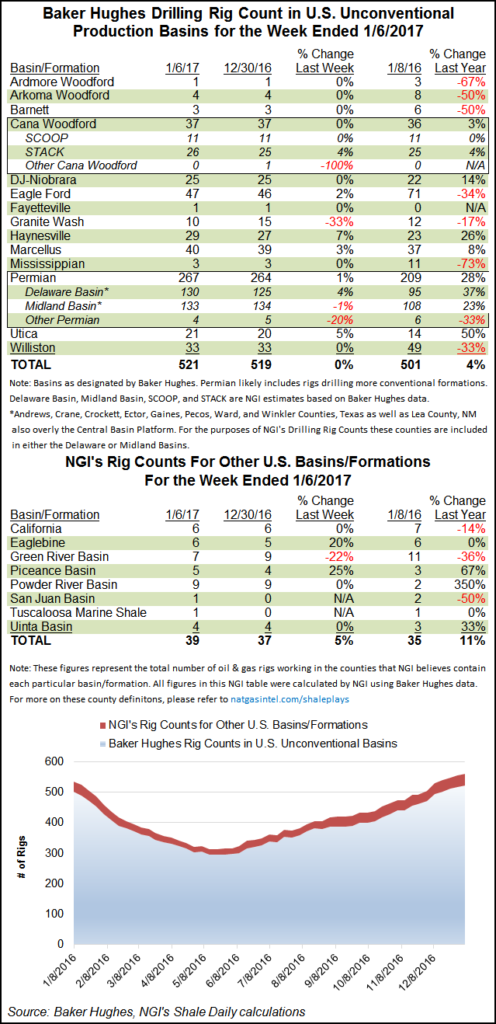

A modest six land-based rigs returned to service in the United States during the week ending Friday, according to Baker Hughes Inc. That was enough to push the current tally to 640, five rigs past the year-ago level. More rigs are coming back this year, and that will mean increased pricing power for oilfield services companies, analysts said.

One rig returned to the U.S. offshore, bringing the nationwide total to 665 rigs running. Four oil rigs returned along with three natural gas units. One directional, two horizontal and four vertical units returned.

The Granite Wash dropped five rigs, but the Permian Basin added three, and the Haynesville Shale added two, putting it well past its year-ago tally of 23 with 29 rigs running now.

Canadian rigs came back in force, an about-face from the previous week. Canada added 48 rigs (29 oil, 23 gas minus four “miscellaneous”). Alberta was up by 23%; British Columbia, 14%; and Saskatchewan, 108%.

Analysts at Raymond James & Associates Inc. wrote in a Tuesday note that they think the U.S. rig count will increase by an additional 250 units, or by about 39%, over the next 12 months.

“Keep in mind, 2017 capital budgets are being set right now, with oil prices higher than the year-ago budget period at sub-$40 oil. We expect E&Ps (on average) to set budgets at a level higher than the strip and to outspend cash flows once again,” Raymond James said.

“On a full-year average basis, we expect the 2017 rig count at 800, up 57% versus the 2016 level of 509. We expect to see especially strong growth in 1H17, with the rig count adding 150 rigs from January through June as rising oil prices and readily available equipment combine for a bullish activity cocktail.

“However, growth in 2H17 is likely to slow as labor and pressure pumping constraints slow the industry’s ability to meet activity demand.”

Indeed, in a Thursday note, analysts at Cowen and Company cited recent conversations with oilfield services companies that point to higher costs in the oil/natural gas patch. “Frack services companies are seeing improving utilization of working equipment and state they require a 20-30% price increase to deploy stacked equipment,” Cowen said. “Land drillers have discussed anywhere from $2,000 to $4,000 dayrate increases. Sand companies have seen $2-4/ton price increases so far with additional increases on the table in January.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |